- About 3 million BTC sit on exchanges, making up nearly 15 percent of Bitcoin’s circulating supply today.

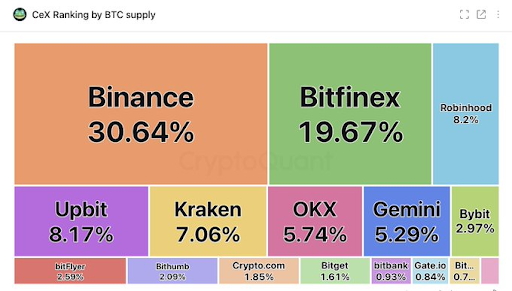

- Binance leads exchange holdings with 30 percent, followed by Bitfinex, Robinhood, and South Korea’s Upbit.

- Analysts report a bullish structure break as Bitcoin trades near $67,458 with rising daily volume levels.

Bitcoin exchange reserves have reached levels that continue to shape market behavior.

Data shared by on-chain analyst Darkfost shows that centralized platforms now hold close to 3 million BTC. This amount equals nearly $200 billion at current market prices. It also represents about 15 percent of Bitcoin’s circulating supply.

Bitcoin exchange reserves reach historic levels

Darkfost explained that Bitcoin trading options have expanded over the years.

Access once depended on a small group of platforms. Today, many centralized exchanges offer yield services and collateral tools for derivatives trading.

Because of this shift, exchanges keep larger BTC reserves to meet liquidity needs. These reserves support fast execution and user withdrawals. As a result, total balances on exchanges continue to grow.

🏦 Over the years, the ways to trade Bitcoin have significantly diversified. Where market access once relied on a limited number of actors, the ecosystem has seen the development of a wide range of centralized exchanges associated with an expanding suite of financial services.… pic.twitter.com/abokMnUd43

— Darkfost (@Darkfost_Coc) February 20, 2026

Current estimates show nearly one in six BTC now sits on centralized platforms. Darkfost said this structure reflects how traders use Bitcoin beyond simple spot trading. The ecosystem now supports lending, margin trading, and structured products.

Binance and rivals dominate BTC holdings

Among open-access platforms, Binance controls the largest share of Bitcoin reserves. The exchange holds about 30 percent of BTC stored on centralized platforms. This position keeps it far ahead of competitors.

Bitfinex follows with close to 20 percent of total reserves. Robinhood and Upbit each hold around 8.2 percent.

These figures show how liquidity concentrates within a small group of major platforms. Traders continue to rely on familiar names for access to Bitcoin markets. This pattern has stayed stable despite past industry shocks.

Investor trust persists after the FTX collapse

The collapse of FTX in 2022 shook market confidence. However, investors still use centralized exchanges heavily. Many believe recognized platforms offer stronger security than personal wallets.

Liquidity depth also plays a major role. Traders need fast order execution and access to multiple services. Lending and staking features keep large balances on exchanges.

Darkfost noted that these factors explain why a large share of Bitcoin supply remains within centralized systems.

Analysts flag bullish structure as BTC price climbs

Market analysts also point to positive price action. Lennaert Snyder said Bitcoin recently broke a key market structure level near $67,320. He described this move as a bullish signal shared with followers on X.

$BTC shows a bullish market structure break.

Finally some action on Bitcoin, price broke market structure by gaining the ~$67,320 high.

This is the bullish MSB I mentioned a lot of times this week, but after days of grinding price finally managed to do it.

I entered… pic.twitter.com/CRPFUmPBRu

— Lennaert Snyder (@LennaertSnyder) February 20, 2026

Snyder added that the next liquidity target stands near $71,453. He also identified $65,631 as the level needed to hold current structure. These updates circulated widely among traders this week.

Daan Crypto Trades commented on the scale of recent liquidations. He noted that the October wipeout ranked among the largest events in Bitcoin history. Altcoins faced even heavier liquidation pressure, according to his post.

Price data from CoinGecko shows Bitcoin trading at $67,458.88. The asset gained 1.45 percent in the past 24 hours. It also rose 0.78 percent over the last seven days.