XRP price is under pressure as whales offload $1.9B in tokens. Analysts are warning of a 30% crash if the $2.65 support fails to hold.

The price of XRP has been under intense pressure lately, especially as the support level at $2.65 faces multiple threats. This level is now the only thing that stands between XRP’s continued recovery and a major correction.

In short, analysts are warning of a possible 30% drop if it fails.

The altcoin has already fallen nearly 19% from its July 18 high of $3.65, and its recent bounce may not be enough to keep the uptrend alive.

XRP Price Under Pressure at Key $2.65 Support

The $2.65 level isn’t just a random number. It is one of the most important markers for the price of XRP. Over the last few months, this barrier has acted as resistance before finally flipping into support in July.

Since then, XRP has tested this level again multiple times.

$XRP update

$2.80s was first area of interest and that has been sliced through

I am watching for a bounce to come in from here down to $2.65 (where quarterly VWAP sits)

Anything below that and the chart is very damaged. Either way not what we wanted to see for any chance of a… pic.twitter.com/Fe4my7ApYs

— Dom (@traderview2) August 2, 2025

According to analyst Dom, $2.65 is in line with the quarterly Volume-Weighted Average Price (VWAP). For context, this is a very important indicator that traders use to gauge whether an asset is trading above or below its fair value.

In essence, if XRP stays above this price, bulls still have a chance to push higher. But if it breaks below, the entire rally from Q2 could be at risk, and a drop toward $2 will become very likely.

Whale Activity Shows Weakness

Another disturbing factor in XRP’s struggle is its whale distribution.

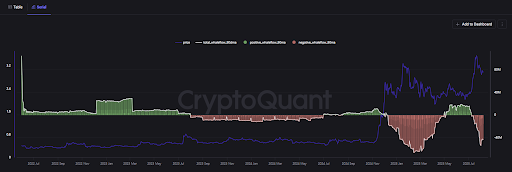

Since July 9, XRP whales have offloaded more than 640 million XRP tokens, worth over $1.9 billion at current prices, according to CryptoQuant.

These aren’t isolated trades either. The 90-day moving average of whale netflows is currently deeply negative. This trend confirms that there has been a consistent pattern of selling over several weeks.

This is the second time in the past year that whales have sold heavily during a rally. Previously, they dumped XRP between November and January as the price rose from $1.65 to $3.27. This time, they’ve sold during the climb from $2.28 to $3.54.

While not all whale outflows are confirmations of selling, the pattern is clear and big investors are exiting.

Technical Signals Back up the Bearish Outlook.

On the weekly chart, XRP’s price has formed higher highs. However, the Relative Strength Index (RSI) has done the opposite. It has formed lower highs since January, confirming a bearish divergence, which is a classic signal that momentum is fading.

Volume has also dropped during the latest push to new highs, which is another sign that buyers may be losing strength. When price rises while volume falls, it often shows an exhausted trend.

If XRP can’t hold $2.65, the next support levels are the 20-week EMA near $2.55 and the 50-week EMA around $2.06. Both could act as safety nets, but only temporarily.

A break below the 50-week EMA would mark a full pump retrace, bringing XRP back to where its rally began.