A lot of action took place in the altcoins’ market last week. Even though most coins exhibited a bearish wave, a handful of altcoins surged unexpectedly. Ethereum ETH price rose to record a week high of $320, last Thursday on Poloniex, before dropping down to $256 as this article is being written. Monero XMR price surged to score a high of around 0.019 BTC on Thursday too, before dropping down slightly to stabilize around 0.0182 earlier today. Litecoin LTC was by far the biggest gainer last week, as it surged from $37.5 last Wednesday to record a new historical high of $57.8 today. Even though Synero AMP price exceeded 27,000 satoshis last Friday, it dropped all the way down to 16,100 satoshis.

Many coins dropped by more than 10% last week including Bitshares BTS, Ethereum Classic ETC, Digibyte DGB, Golem GNT, Next NXT, GameCredits GAME and Bytecoin BCN.

If you followed our altcoin picks for last week, then you most probably managed to make some profit trading Ethereum ETH and Dogecoin DOGE. If you didn’t manage to sell your bought Ripple XRP, hold on to them for another week.

So, which coins are we going to buy this week?

STEEM:

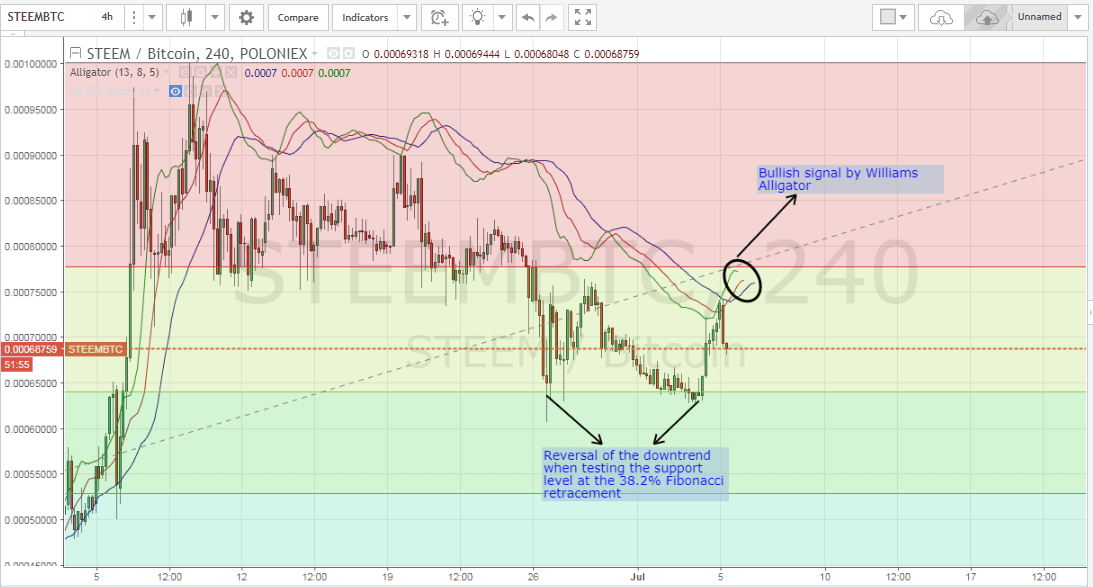

Last week, STEEM price rose to 74,200 satoshis before dropping down to 68,750 at the time of writing of this article. We can examine the 4 hour STEEMBTC chart from Poloniex, while plotting the Williams Alligator indicators (look at the below chart) to predict price movements.

Let’s plot a Fibonacci retracement that extends between the low recorded on the 13th of March (0.00005556 BTC) and the high recorded on the 9th of June (0.000100087 BTC) to identify key resistance and support points. As noted on the above chart, the 38.2% Fibonacci retracement, which corresponds to the 63,976 satoshi price level, is presenting a strong support level that prevented further price drop, as it was tested more than once during the past couple of weeks. The downtrend that has been pulling price to lower levels, during the later half of June, was reversed after testing the 38.2% FIb retracement level and 6 successive bullish candlesticks were formed afterwards. As Williams Alligator is exhibiting a bullish signal, we can expect STEEM price to rise to test the resistance around the 77,778 satoshi price level, which corresponds to the 23.6% Fib retracement, yet we can see it drop firstly towards 63,976 satoshis before rising.

I recommend buying STEEM at 69,000 satoshis and then setting a sell order for the bought coins at 77,778 satoshis.

GameCredits GAME:

Even though GAME price rose to a high of 149,257 satoshis last week, it dropped down to 127, 391 as this article is being written. We can plot a Fibonacci retracement between the low recorded o the 27th of May (50,029 satoshis) and the high recorded on the 3rd of June (207,531 satoshis) on the 4 hour GAMEBTC chart from Poloniex to determine key resistance and support levels (look at the below chart).

The resistance around the 38.2% Fib retracement (147,365 satoshis) resisted continuation of the uptrend when tested last Monday, as price overshot slightly above this critical level before the uptrend was reversed. Right now, price is moving almost parallel to this level, but is expected to rise to test the 38.2% Fib retracement level again within the next few days.

I recommend buying GAME between 126,000 and 127,000 satoshis and then setting a sell order for the bought coins at around 147,000 satoshis.

Giga Watt WTT:

Giga Watt is a new promising altcoin that provides a myriad of mining services, as every WTT token is a form of a contract that gives its owner the privileges to use the Giga Watt’s processing resources for 50 years absolutely free.

Currently, WTT price equals 0.000367 BTC at Hitbtc (around $1.4) and in my opinion, has the potential to exceed 0.001 BTC within the next 1-2 weeks.

I recommend buying WTT somewhere between 0.000350 and 0.0004 BTC and then setting a sell order for the bought coins at 0.0001 BTC or even at 0.001 BTC.

Charts from Poloniex and Hitbtc