Recently, according to research from AOFEX digital asset exchange and trading platform, after monitoring and researching the recent data on the cryptocurrency market, the reasons for the current rise in bitcoin (BTC) price are caused by a variety of exogenous factors, and the rise is likely to continue. As a leader in the cryptocurrency market, BTC has established stable, mature and credible asset attributes in a decade.

Through the study of tracking and analyzing the long-term trend lines of BTC, it is discovered that the intrinsic value of BTC is deciding the bull-bearing conversion of every cycle, because extrinsic of exogenous factors are affecting less and less. According to the research report, three progressive layers of factors drive the rise in BTC: Firstly, after ten years of development, BTC has been gradually blended in daily life of individuals; In addition, being accepted means that the doubt with BTC have been gradually disappearing; Lastly, attitudes of BTC by individuals have turned more positive and optimistic.

Market emotions reflect on the behavior of authorities. Financial experts and scholars start to re-examine their attitudes toward BTC. In the meantime, traditional institutions start to bet on Bitcoin.

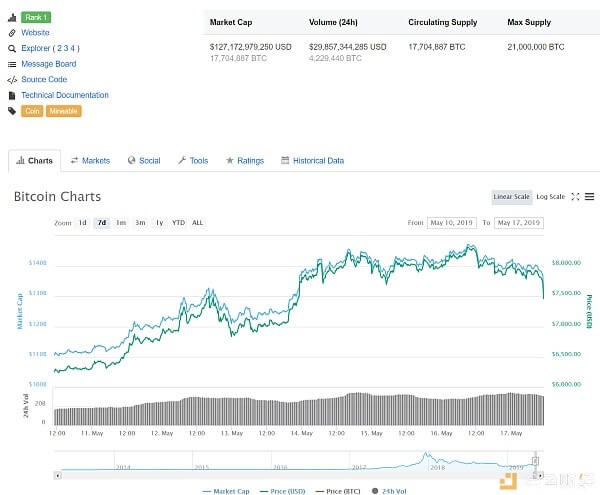

Bitcoin has soared from $5,075 on April 15 to recent $8,178, and it is likely to reach higher after adjustments.

According to the research by AOFEX, the fluctuations in the price of bitcoin and altcoin are inevitable phenomena, because all new industries have to go through such a phase. To a certain extent, the boom-bust of bubbles somehow reflect the growth and maturity of the industry.

AOFEX’s report continues to mention that due to the leading nature of Bitcoin, its increasingly mature attributions will affect the entire cryptocurrency market for sure. As a result, the maturity of the entire cryptocurrency market will become an inevitable trend. The process of cyclical recovery will flourish in the cryptocurrency market.

For individual investors, it is important to reduce the deadweight loss caused by non-systematic risks so that they can get ready for the bullish market. As the price of BTC changes, investors could efficiently receive stable returns and hedge risks by NSO trading on AOFEX.

SOCIAL MEDIA

- Twitter: https://twitter.com/aofexp

- FB: https://www.facebook.com/AofexDigitalCurrencyExchange/

- Medium: https://medium.com/aofex

- YouTube: https://www.youtube.com/channel/UCn4m23npETbhevQMl9_XRtg

- Telegram: t.me/aofex

- Telegram In Chinese: t.me/aofexcn

- Meetup:https://www.meetup.com/AOFEX-Official-Launch-Expo-London/

- Email: aofex@aofex.uk