Key Insight:

- Bitcoin recently reclaimed the $107k price level and major moving averages, which shows an incoming surge to $120,000.

- A massive drop in Bitcoin inflows to exchanges shows that investors are less likely to sell.

- The current Bitcoin inflow/outflow ratio is mimicking levels seen at the beginning of the 2023 bull market.

Bitcoin is back in the spotlight after reclaiming one of its most important technical levels and showing signs of lower short-term selling pressure.

The cryptocurrency is now trading just above $107,000, and some analysts believe the next stop could be as high as $120,000. This optimism is fueled by falling inflows to exchanges, macro conditions, and several bullish technical patterns.

A Drop in Bitcoin Inflows Shows Confidence

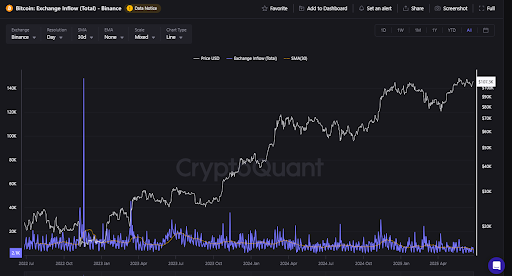

One of the strongest signals for Bitcoin’s upward movement is in the data from Binance. According to recent insights from CryptoQuant, the 30-day moving average (DMA) of BTC inflows to Binance recently dropped to just 5,147 BTC.

That’s less than half the monthly average during previous bear markets, even as prices continue to hover above $105,000.

For some context, in December 2024, when Bitcoin was trading below $100,000, the inflow rate was over 13,000 BTC.

The difference between today’s low inflow levels and current higher prices shows that fewer holders are looking to cash out. In crypto markets, a drop in exchange inflows tend to show reduced selling pressure and rising investor sentiment.

According to insights from Bitcoin researcher Axel Adler Jr., the current inflow/outflow ratio is still relatively high. It is similar to levels last seen at the beginning of the 2023 bull market.

Meanwhile, the inflow/outflow ratio (Inflow/Outflow 30-day SMA) remains at a high level, comparable to the end of 2023 -beginning of the bull market, which indicates still strong demand for BTC. pic.twitter.com/MlgxQwqbfJ

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) June 25, 2025

This shows that while coins may be moving in and out of exchanges, net outflows are still dominant. In essence, investors are most definitely holding, not selling.

Why Reduced Inflows Matter

Historically, spikes in BTC inflows to exchanges mostly happened during moments of panic or profit-taking.

For instance, during the FTX collapse in late 2022, monthly inflows spiked to around 24,000 BTC, in a clear case of fear-driven selling. The fact that we are now witnessing the opposite (low inflows despite high prices) shows that there is an ongoing change in investor behavior.

Many traders are no longer rushing to sell into strength. Instead, they seem to be expecting more upside for the cryptocurrency, especially with the ongoing support from technical indicators and the improving macroeconomic sentiment.

Bitcoin’s Reclaim of the 50-Day EMA

Another interesting indicator that investors are watching is the 50-day exponential moving average (EMA). Recently, Bitcoin dipped below this line. However, it quickly recovered, and posted three consecutive daily closes above it.

According to insights from crypto trader Ibrahim Cosar, this kind of recovery has often come before breakout rallies.

“Historically, brief pullbacks below the 50-day EMA, followed by quick reclaims, often lead to rallies of 10% to 20%,” he said. Cosar believes this setup could be what Bitcoin needs to push toward the $120,000 level.

Meanwhile, technical indicators are flashing more green lights. The rising cumulative volume delta (CVD) spot indicator shows that there is some strong demand for Bitcoin, even in the spot market.

With this in mind, it is safe to assume that bulls are in control.

What Could Derail the Bitcoin Rally?

Despite the optimism, there are still many risks to be aware of.

Bitcoin is sensitive to geopolitics at this point, and the tensions in the Middle East or a surprise jump in inflation could spook markets and ruin Bitcoin’s movement.

Additionally, while the reclaim of technical levels like the 50-day EMA is encouraging, any downturn in spot demand (especially if mirrored by an increase in exchange inflows) could quickly reverse sentiment.

Bitcoin is on the breakout with Spot demand visible on the aggressive CVD Spot.

Bulls are in favor now. https://t.co/h7K2UQf3Cd pic.twitter.com/IbG0jhr7PP

— IT Tech (@IT_Tech_PL) June 25, 2025

Bitcoin’s path toward $120,000 is gaining ground fast.

However, as always with crypto, the road is rarely ever straight. For now, though, the bulls have the upper hand and if the trend continues, we could see Bitcoin run straight towards $120,000 soon.