Bitcoin dominance continues to rise in November even with its price falling to its lowest level in over a year. Despite the current bear market, permabulls and institutions still maintain that the top-ranked cryptocurrency has enormous potential.

Bitcoin Still King Despite Bear Market

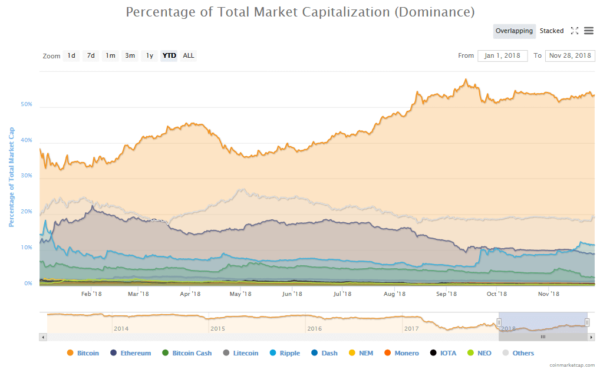

Presently, the BTC dominance stands at 53.6 percent with a market capitalization of $72 billion against a total cryptocurrency market capitalization of $135 billion. Like the rest of the market, BTC’s price has taken a tumble since the middle of the month.

At the start of the month, BTC’s market share stood at 51 percent. However, this figure has risen steadily throughout the month. One primary reason for this rise is the fact that altcoins have seen higher price drops that BTC.

To get some perspective of why BTC is still king, consider the following. The top-ranked cryptocurrency is currently down by 34 percent since November 14, 2018. During that same period, most top ten altcoins have declined by more than 40 percent.

Bullish Optimism Unaffected by Price Drop

Price decline aside, many commentators are still espousing positive sentiments regarding the future of BTC. Recently, renowned venture capitalist and BTC bull Tim Draper said that cryptocurrencies would lead the future of global finance. According to Google Trends, interest in BTC is at an eight-month high.

Apart from individuals, institutions are also sounding the same tune, even appearing to commit considerable resources into the market. Recently, Live Bitcoin News reported that Nasdaq was considering moving forward with its plans to list BTC futures pending a favorable response from regulators.

Bitcoin Back Above $4,000

As at press time, the top-ranked cryptocurrency surged past the $4,000 mark, gaining over 11 percent within the last 24 hours. Since dropping below $4,000 last Saturday (November 24, 2018), the BTC price tested the $3,500 resistance level a couple of times. Bitcoin managed to hold off on both occasions, bouncing even higher.

Commentators like Mati Greenspan of eToro identify $3,500 and $3,000 as critical support levels for Bitcoin. Elsewhere, Wednesday’s trading also sees positive price gains for the market as a whole. Monero (XMR) is the highest gainer so far among the top ten coins, rising by 15 percent in the last 24-hour trading period. Verge (XVG) is the highest gainer in the top 100, with an increase of 47 percent.

Do you think Bitcoin’s market dominance can go above 60 percent when the dust settles after the current bear market? Let us know your thoughts in the comment section below.

Images courtesy of Coinmarketcap.com and Shutterstock.