As bitcoin hits $13,000 Dennis Gartman has said he still won’t be trading in it, claiming that the volatility ‘frightens’ him.

Since the beginning of 2017, the digital currency has seen its value increase 13-fold. Just yesterday, it was reported that it had reached a new high after pushing through the $12,000 barrier. Yet, ahead of Chicago-based exchanges, Cboe and the CME Group launching their bitcoin futures contracts later this month, the cryptocurrency is continuing its skyward ascent.

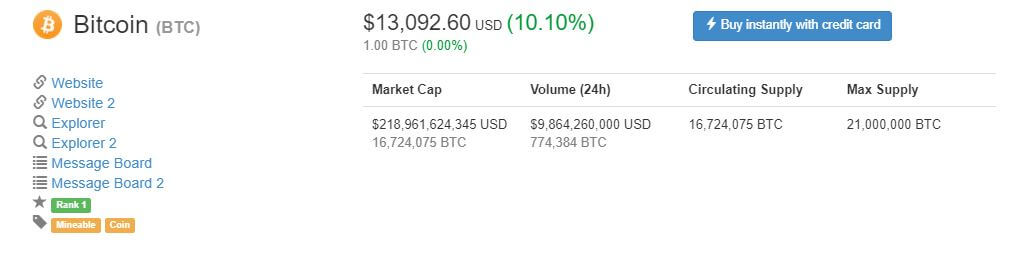

As a result, at the time of publishing it has peaked to a new record, at just over $13,000, according to CoinMarketCap, pushing its market value to $218.9 billion for the first time. The combined cryptocurrency total is now worth is impressive $377.9 billion, making it worth more than JPMorgan Chase, at $366 billion for the first time.

Yet, despite these impressive gains, Gartman isn’t changing his position on the digital currency. Speaking to CNBC’s ‘Fast Money‘, he argued:

Bitcoin on a volatile day moves 15 and 20 percent. How can you margin something that can move 15 to 20 percent on a regular basis? It’s the volatility that frightens me.

He added that the digital currency is a ‘modern day Tulip bubble’ that is ‘waiting to pop.’

However, despite his negative views regarding bitcoin, he did state that the launch of the futures contracts would bring a ‘sense of legitimacy’ to it. Of course, this was by no means his way of softening his stance toward it, adding that he wasn’t going to start trading in bitcoin anytime soon.

He said he would only be interested in it:

When they begin to pay taxes on it, when it ceases to be an avenue for avoiding taxes, when it ceases to be a place where drug dealers are trading and making transactions.

Only yesterday, it was reported that a Yale professor had made the argument that bitcoin was a ‘dangerous speculative bubble.’ According to Stephen Roach, a Yale University senior fellow and the former Asia chairman and chief economist at Morgan Stanley, ‘like all bubbles, they burst,’ adding:

They go down, and the one who’s made the last investment gets hurt the most, there’s no question about it.

However, billionaire hedge fund manager, Mike Novogratz, who has predicted that bitcoin will reach $40,000 by 2018, is worried that the digital currency’s continuing rise will see more government regulation. Speaking yesterday on CNBC’s ‘Power Lunch,’ he stated:

I’ve got concern that if price movements go higher we’re going to get more regulation.

Featured image from Shutterstock.