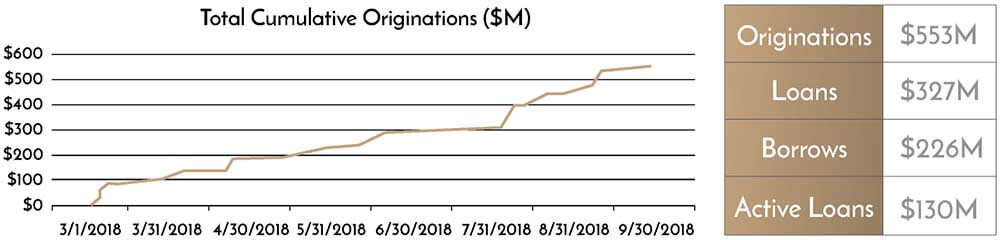

Crypto loans appear to be in high demand. This somewhat unusual business model is generating a lot of excitement. Genesis Capital has seen the number of loans issued through its platform increase significantly. Over $550m worth of cryptocurrency has changed hands over the past seven months.

Genesis Capital is on the Right Track

In March of 2018, Genesis Global Trading, an OTC cryptocurrency trading firm, launched its crypto lending platform in response to growing customer demand. Through its affiliate company, Genesis Global Capital, institutional clients are able to lend and borrow a variety of cryptocurrencies. The success to date has been far more spectacular than anyone could have predicted.

According to the company’s most recent report, 2018 has proven to be quite prosperous. To date, Genesis Capital has originated more than $550 million in crypto loans. Their clients are all institutional-level, further confirming the demand for exposure to Bitcoin and other cryptocurrencies. Interest in Ethereum is on the decline, whereas XRP, Litecoin, and Ethereum Classic have become a lot more popular.

Nearly a dozen cryptocurrencies are supported on the platform, though Bitcoin still remains the go-to asset. It is the most widely used asset and benefits from a very strong market position. Surprisingly, most borrowers use BTC for working capital needs. Ethereum is primarily in demand for short interests. Other trading firms also rely on Genesis Capital to borrow Bitcoin. This is primarily due to a boom in derivative markets.

The Future of Cryptocurrency Lending

Despite falling prices for all cryptocurrencies this year, Genesis Capital shows there is still a bright future ahead. Unlike traditional financial assets, Bitcoin and altcoins are global. As such, requesting and extending loans around the world becomes a lot more straightforward.

Hedge funds have begun paying more attention to this company as well. This shows interesting things are bound to happen across the cryptocurrency industry. Moreover, it shows these companies believe digital assets are here to stay. Whether in the form of lending or something else entirely, the demand appears to be genuine.

As one would expect, cryptocurrency lending can serve many purposes. September was a monthly primarily focusing on operating work capital. Trading and arbitrage both remain incredibly popular as well. Speculating and hedging are on the decline a bit, yet still present. Genesis Capital is confident derivative markets and their products will continue to mature. This will lead to even more demand for these types of loans in 2018 and beyond.

Do you think that the cryptocurrency lending market will continue to grow? Let us know in the comments below.

Images courtesy of Shutterstock, Genesis Capital