Ethereum jumps 20% to $4,300 in a month as institutions raise shorts and whales accumulate. What’s next for ETH’s future?

Ethereum (ETH) is at the centre of some strong market tension. The cryptocurrency has rallied more than 20% in the past month, after rising from June lows of $2,100 to over $4,300 by mid-August.

Despite the recovery, Ethereum is under pressure from a new development from the short positions that could set up a short squeeze.

Market Split Between Bulls and Bears

Whales and institutional buyers continue to accumulate ETH, and are adding momentum to the price rally. Data shows $378 million in stablecoins flowed into Ethereum over the past 24 hours. This shows a great deal of demand that has challenged bearish traders who expected a deeper correction.

The surge in short positions started early this year and has now reached record highs, according to recent updates from Bitcoinsensus.

🚨 Institutional Shorts on Ethereum Hit Record Highs 🚨

CME data shows Ethereum shorts by institutions just reached an all-time high 🧨

ETFs are stacking $ETH… while futures markets are heavily betting against it. One side is about to be very wrong. 👀#Ethereum $ETH pic.twitter.com/PdNTsy6N08

— Bitcoinsensus (@Bitcoinsensus) August 18, 2025

Institutions have been particularly active in shorting ETH through CME futures. This indicates that large players are becoming cautious, even as retail traders and whales increase exposure.

The standoff has created an ongoing battle between bulls and bears. If prices continue to rise, short sellers may be forced to cover their positions. This could trigger a squeeze and push prices further upwards.

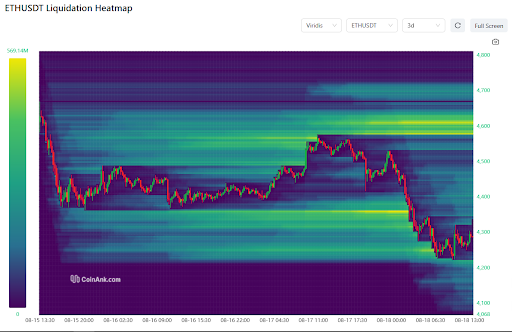

However, if ETH falls below support at $4,200, long positions worth over $2 billion will be at risk of liquidation.

Ethereum Technical Levels in Focus

Ethereum’s recent moves have been volatile. Earlier in August, ETH briefly dipped under $2,500 amid geopolitical uncertainty from the Trump tariffs. However, the price quickly rebounded and is now trading well above that low.

Analysts are pointing out $4,200 as an important support level for the asset. Particularly, a sustained move below it could cause a cascade of liquidations.

On the upside, resistance is clustered between $4,550 and $4,571. Which means that a break above this range could open the path toward $5,000.

According to the charts, Ethereum is currently battling with a rejection from the $4,788 price level and a possible retest of $3,875.

If the bulls are unable to defend the $3,875 zone from attack, Ethereum is likely to trek further downwards and test the $3,293 price level.

Traders Weigh Liquidation Risks

The rise in shorting has made Ethereum trading risky. Analysts are warning that if ETH slips below $4,200, long positions could face forced liquidations. This scenario would increase volatility and possibly push the price back toward the $3,800 region.

For traders, it is important to manage risk properly. Market conditions can be unpredictable, and short squeezes tend to create rapid upside moves, just as liquidations can create sharp declines.

In all, Ethereum’s year-to-date performance has been strong. However, its immediate future shows a need for caution.

Analysts are pointing to the ETF market inflows and whale confidence as evidence that ETH can aim for $5,000. However, the bears are pointing towards the high institutional shorts as reasons why prices could be at risk of a crash soon.