Banking in the future will undeniably have cryptocurrency services included alongside existing fiat currency based systems. Given the fact that most of the fiat based banking operations happen electronically these days, the inclusion of crypto support won’t be a big shift. However, lack of clarity on cryptocurrency regulations and decentralized nature of these digital currencies which doesn’t require the banks as middle men or trusted party has been responsible for making banks not only ignore but detest cryptocurrencies.

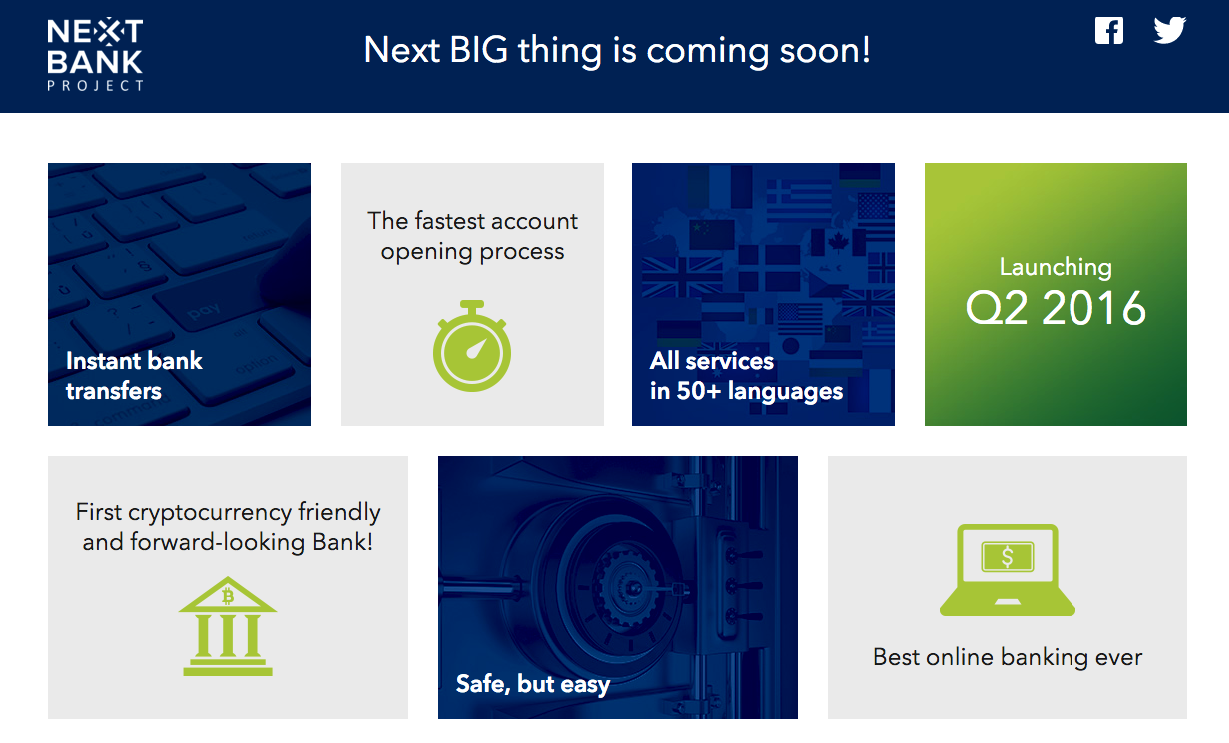

The NextBank Project is going to change all these. Slated for release on the second quarter of 2016, the project is currently undergoing final stages of development. Started by Dim Voloshinsky, NextBank presents itself as the first bitcoin friendly bank in the world. According to information available on the website, NextBank will be offering a wide range of services to its customers. Some of the services include

Multicurrency Bank Accounts – NextBank proclaims that it will be supporting over 135 different currencies including cryptocurrencies and even precious metals like gold, platinum etc.

International Debit Cards – NextBank account holders will be eligible for international debit cards, similar to that of an account holder in any other bank. NextBank users will be able to choose between Visa, MasterCard and China’s UnionPay for their debit cards.

Escrow Services – When a bank proclaims itself to be bitcoin friendly bank, it must offer escrow services. As we know, bitcoin transactions are irreversible unless the refund process is manually initiated by the recipient. In order to overcome such challenges, any transaction involving bitcoin will need escrow service to ensure the safety of funds.

Currency Exchange – NextBank users will be able to exchange their currency to any currency of choice over NextBank at the best available exchange rates. NextBank claims to offer the service round the clock.

Expedited Money Transfer – The bank will support expedited money transfer through intra-bank, SWIFT and Western Union transfers.

The extensive support offered by NextBank enables the platform to offer P2P, C2B B2B and B2C transaction capabilities to its users.

NextBank is registered in the South Pacific nation of Vanuatu and intends to have branch offices set up in the United Kingdom, France, Spain, Russia, China, Germany and Malaysia by mid-2016. While the project looks exciting on paper, we are yet to see how it will really pan out to NextBank once it is launched. Also, there is a question of customer adoption which only time will tell.