Bitcoin’s wild bullish run during the past couple of months has begun to have its effects on the global economy, especially the stock market. Whether the growth bitcoin witnessed during 2017 was a bubble or not, no one can deny the fact that bitcoin was a great investment for all of those who came on board in 2017 as its value increased by around 2000%. However, after reaching an all time high of around $20,000 earlier this month, bitcoin price started crashing recording a monthly low of $10,750 before rising again to $15,580 today.

Even though bitcoin, and cryptocurrency in general, are still mostly traded by speculators rather than traditional investors, the crypto-economy has grown to the point that its crash would definitely influence other markets, especially in the technology sector. On an interview that was broadcast on CNBC last Friday, Chris Harvey, head of equity strategy at Wells Fargo, discussed how the bitcoin market can influence the stock market and warned of “collateral damage” secondary to a bitcoin crash.

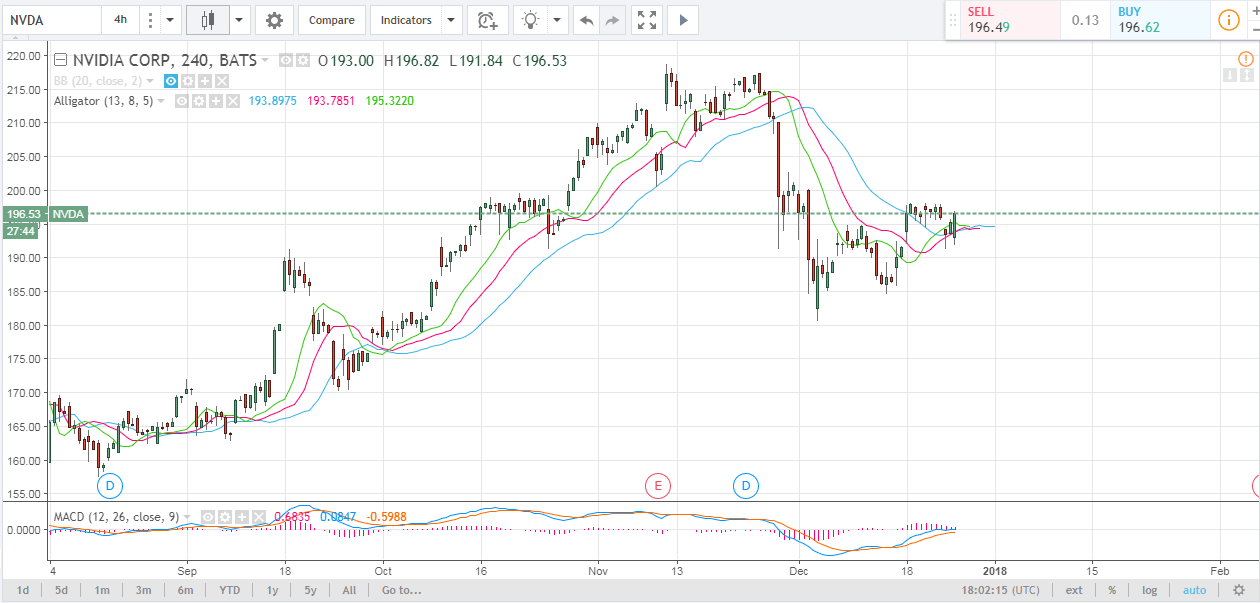

The drop in bitcoin price has begun to cast its shadows on some stock. The stock of semiconductor manufacturers, which make chips that are used in cryptocurrency mining, Nvidia (NVDA) and Advanced Micro Devices Inc. (AMD) declined as bitcoin price started to drop. NVDA dropped by around 10% during the past 4 weeks, while AMD declined by around 9% during the same period.

Why Did The Price of AMD & NVDA Decline in Response To Bitcoin’s Crash?

AMD and Nvidia are likely to get affected by the recent decline in bitcoin price, due to the fact that they manufacture graphic processors (GPUs), that are used in bitcoin mining or more importantly the mining of other cryptocurrencies, as bitcoin is now mostly mined via ASIC miners. The growth of bitcoin also boosted the growth of other cryptocurrencies, including Monero, Litecoin, Ethereum and others, which can be mined efficiently via GPUs. As such, 6.7% of Nividia’s Q2 revenues were generated by GPU sales for those using them in cryptocurrency mining accounting for more than $150 million of graphic card sales to miners.

So, when 5% of more of a business’s revenue is related to cryptocurrency, it is rather logical to see it suffer when bitcoin price crashes. Nevertheless, as many retail banks and fintech startups are investing huge amounts in the blockchain technology, bitcoin is now just a small block in the world of the blockchain technology and so effects of its recent price crash are likely to be more or less limited. The drop in the prices of NVDA and AMD are likely to be limited, so we are mostly going to see them recover soon.

Chart from Tradingview.com