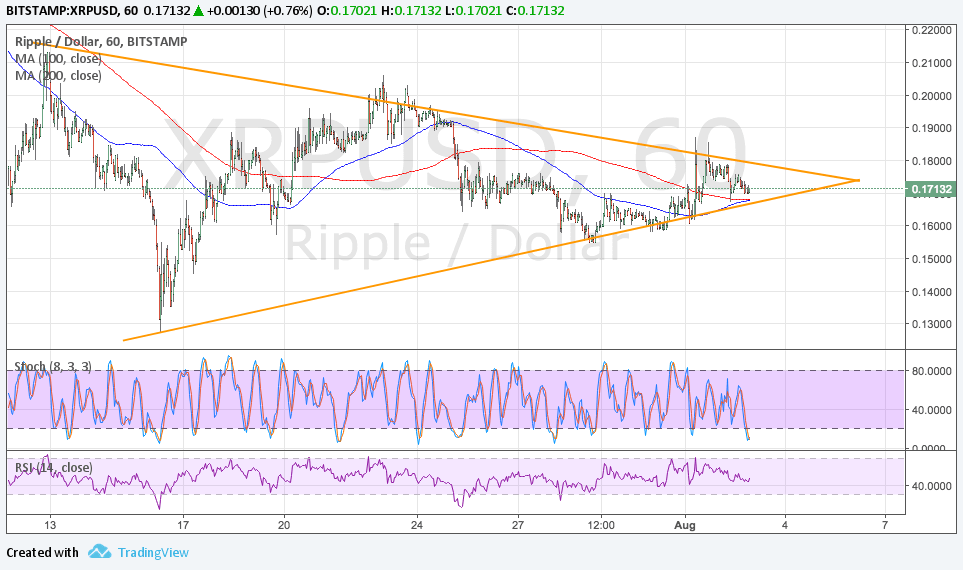

Ripple failed to break past the symmetrical triangle resistance on its recent test so it’s now back to testing support. If it holds again, price could make another attempt to move past the 0.1800 resistance. A breakout is bound to happen soon since Ripple is approaching the peak of the formation and consolidation has been getting tighter and tighter.

The 100 SMA is starting to cross above the longer-term 200 SMA to signal that the path of least resistance is to the upside. In other words, a break past the resistance might be more likely than a break lower. Note that the chart pattern spans 0.1300 to 0.2200 so the resulting rally or selloff could be of the same height.

Stochastic is heading south to show that sellers have the upper hand but they might be forced to give up this advantage now that the oscillator is dipping into oversold levels. RSI continues to tread sideways to signal further consolidation. In that case, price could keep bouncing off support and resistance until either buyers or sellers catch a good catalyst.

Cryptocurrency traders appear to be sitting on their hands for now, trying to wait and see if any issues come up from bitcoin’s split into two different versions. So far, there have been no major troubles but it looks like investors are not keen on upping their holdings on the likes of Ripple either.

For the time being, dollar price action might have a strong say in XRPUSD behavior as the attention is focused on the upcoming NFP report. A higher than expected read could reinforce Fed rate hike expectations as the central bank might need to act even though inflation has been subdued. A weak read, however, could still keep December hike speculations in play but at weaker odds.

Fed officials have been expressing their thoughts on the balance sheet runoff and another Fed rate hike, with the general sentiment in line with the FOMC bias of being more cautious this time. A weaker dollar could allow cryptocurrencies like Ripple to advance, barring any negative industry news down the line.