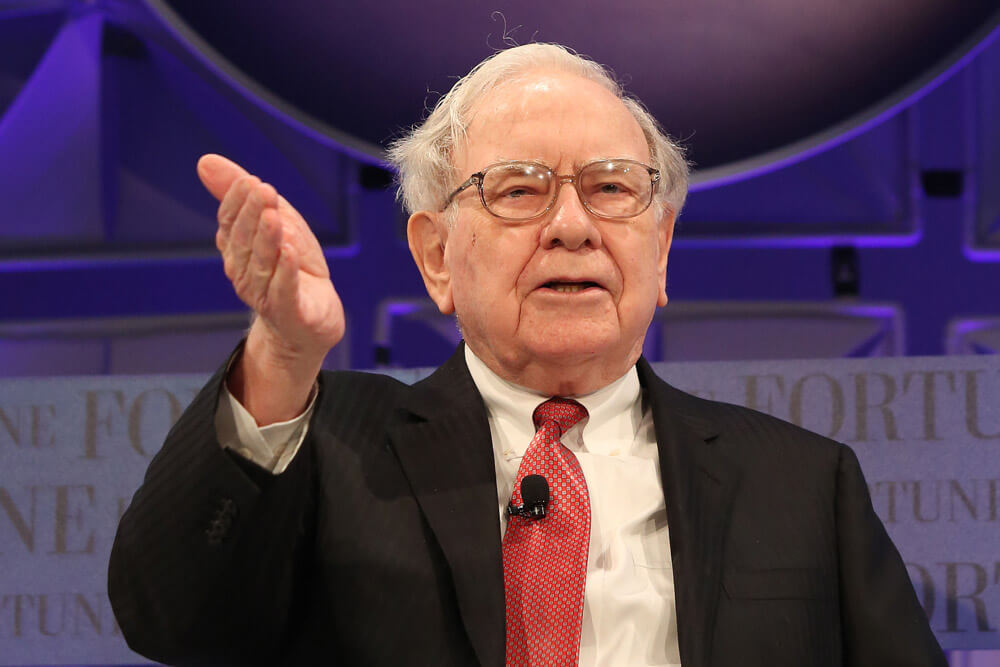

Warren Buffett has never been a big fan of bitcoin, but his recent comments regarding the digital asset reflects a whole new attitude of resentment and distrust.

Why So Much Hate for Bitcoin?

In his latest interview with CNBC, the CEO of Berkshire Hathaway comments that bitcoin hasn’t done much for society, stating:

It’s a gambling device. There’s been a lot of fraud connected with it. There’s been disappearances, so there’s a lot lost on it. Bitcoin hasn’t produced anything. It doesn’t do anything. It just sits there. It’s like a seashell or something, and that is not an investment to me.

He also compared bitcoin to a button on his coat, explaining:

I’ll tear off a button here. What I’ll have here is a little token… I’ll offer it to you for $1,000 and I’ll see if I can get the price up to $2,000 by the end of the day… but the button has one use and it’s a very limited use.

Buffett acknowledges that blockchain technology is very big and revolutionary but believes it doesn’t need bitcoin to thrive. When asked if Berkshire Hathaway is or would ever consider getting into blockchain, Buffett stated:

Blockchain is very big, but it didn’t need bitcoin. J.P. Morgan, of course, came out with their own cryptocurrency… We are probably doing it indirectly, but no. I wouldn’t be the person to be a big leader in blockchain.

Buffett isn’t the only executive at Berkshire Hathaway to have a strong dislike of bitcoin. His vice chairman, Charlie Munger, recently said that trading bitcoin was “just dementia.” He also commented, as covered by Live Bitcoin News on 5/4/19, that trading or praising bitcoin was like enjoying the “life and work of Judas Iscariot,” the man who betrayed Jesus in the Bible.

He stated:

I think the people who are professional traders that go into trading cryptocurrencies, it’s just disgusting. It’s like somebody else is trading turds and you decide, ‘I can’t be left out.’

In a previous interview, Buffett said that bitcoin was like “rat poison squared,” and commented that:

In terms of cryptocurrencies, generally, I can say with almost certainty that they will come to a bad ending. If I could buy a five-year put on every one of the cryptocurrencies, I’d be glad to do it, but I would never short a dime’s worth.

What’s Buffett’s Point, Exactly?

It’s hard to really understand where Buffett’s comments are coming from. Yes, it’s true that bitcoin has been vulnerable to fraud and theft in the past, but it has also delivered great profit to investors, particularly early ones during the December 2017 rally that took its price to roughly $20,000. While the currency has its flaws, comparing it to “rat poison” and saying it’s simply a “gambling device” is too dismissive of its positive qualities.