A Bitcoin whale has transferred $194 million worth of the asset in 30 minutes, costing just $0.10 to do so. Maybe now Bitcoin naysayers will lay off the tired “high transaction fee / slow transaction time” argument.

A Whale-sized Hole in Bitcoin Critics’ Arguments

According to Blockchain’s block explorer, the transaction took place on October 15th at 7:40 pm. It saw the output movement of 29,999 bitcoins – amounting to nearly $198 million at the time of this writing.

Considering how much criticism the Bitcoin network receives over the supposed “high fees” involved in processing transactions, this news comes as a vindicating breath of fresh air. It is true that back in December, during the market bull run, Bitcoin’s blockchain transaction fees rose as high as $55 and transactions were taking hours – sometimes days. Since then, however, transaction fees – and times – have come down significantly.

“Transaction fees are only down because the market has crashed.”

This is a common rebuttal used by critics when someone points out how transaction fees have decreased, so let’s take a look at that argument.

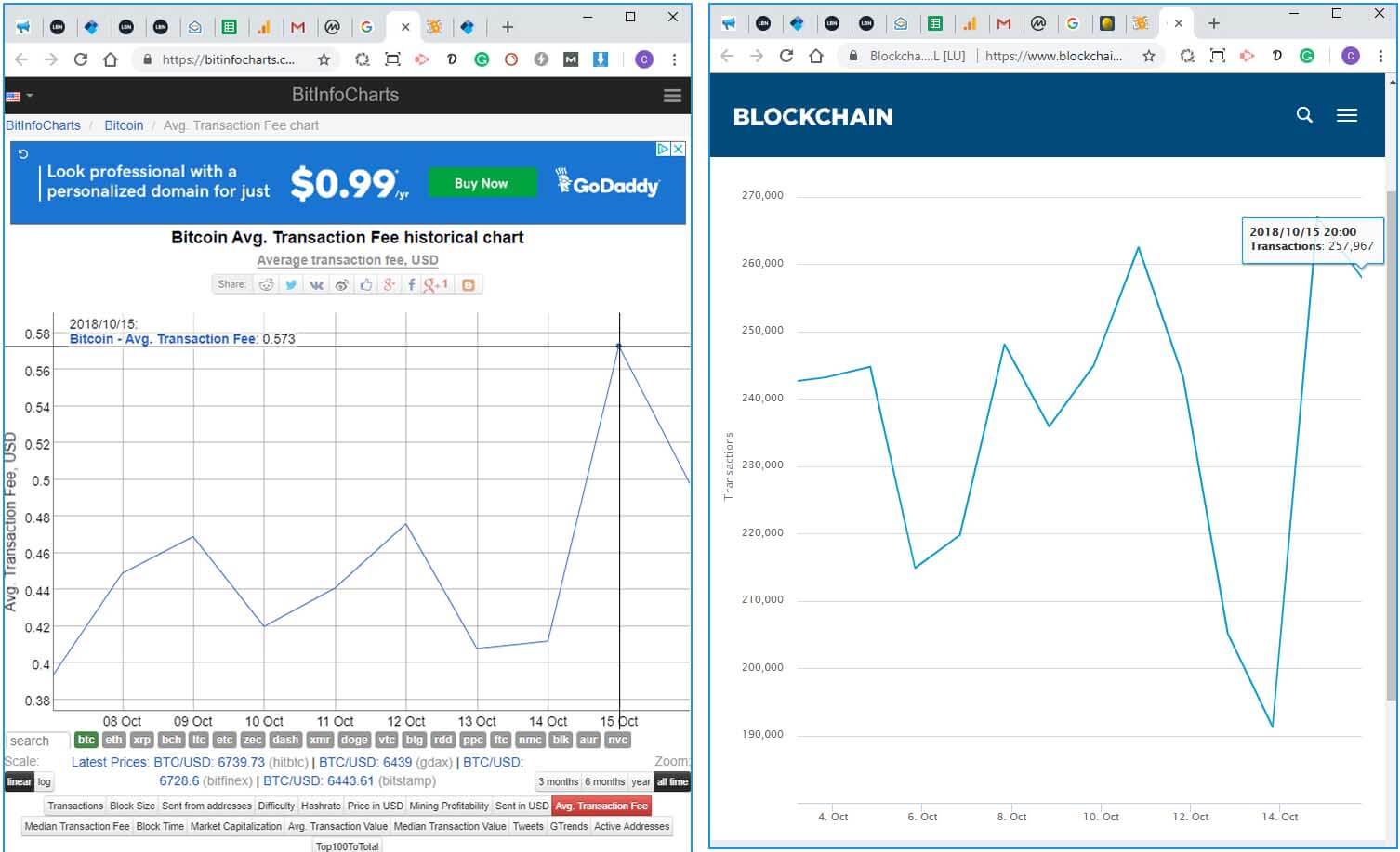

The highest transaction fee paid in 2017 was roughly $55, paid on December 22. That same day, there were approximately 380,000 Bitcoin transactions sent over the network. Now let’s take a look at October 15, 2018:

If you look at the charts above, on October 15th there were somewhere around 250,000 transactions that day – that’s roughly 65% of the number of transactions on December 22, 2017, when transaction fees climbed as high as $55. Now compare the average transaction fees. The average transaction fee on October 15th was just $0.57 – a little more than 1% of that magic $55 transaction fee that critics like to wave about.

Even if you compare average transaction values on those days ($2.46 billion vs. $903.5 million), it still doesn’t jive. There is far more at play with the reduction of transaction fees than just a bear market. The adoption of Segwit and other scaling solutions like Lightning Network, however, are bringing those fees down to a much more manageable level.

Of course, it will be interesting to see whether the next bull run will see a return to exorbitantly high fees or if Bitcoin is truly becoming more scalable. For now, though, it should silence some naysayers who have been against Bitcoin from the beginning. But will Bitcoin’s most recent – and most vocal – critics be among them?

Mother of all Bubbles

Known as “Dr. Doom,” professor of economics at New York University Nouriel Roubini has not been shy about his negative opinion of the crypto asset, even going so far as to air his myopic opinions before the U.S. Senate.

Back in February, he called it the “mother of all bubbles,” after it fell 12 percent. More recently, he called the crypto market a “stinking cesspool.” Yet, while he repeats the same tired expressions about the market, he really hasn’t had much impact on the market.

In fact, it’s comments like his that rally the community together to fight back at his words. Notably, though, while he claims that the market is a bubble, he fails to understand, or even comprehend, how much good it is doing. This is particularly the case when it comes to people who have no access to traditional finance. Or people who send money abroad through money transfer providers.

The fact that it enables disenfranchised populations to gain access to a form of money says a lot. It’s certainly more than what Roubini is doing, which is just emitting a lot of hot air.

How do you think this will impact the naysayers? Do you think they’ll remain as they are? Let us know in the comments below.

Images courtesy of Shutterstock, Bitinfocharts, Blockchain.com