Cryptocurrencies and ICOs are faced with continued regulatory pressures, but this doesn’t appear to be slowing them down. In fact, cryptocurrencies, are still much higher than their 2017 inception points, even though many are in negative territory thus far in 2018. ICOs are getting close to breaking their 2017 fundraising record of almost 3.9 billion USD, as 2018’s total already stands at a respectable 3.4 billion USD.

99bitcoins.com keeps a rolling list of companies that accept cryptocurrency payments, and the list is still growing. Major companies including Subway, Microsoft, Virgin Galactic, and Bloomberg.com are featured on this list, demonstrating that large, profitable ventures believe in the long-term success of the emerging technology.

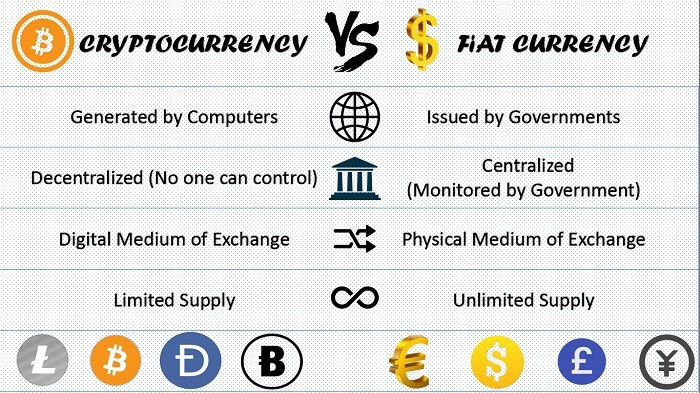

Nevertheless, not everyone is a believer in cryptocurrencies and its underlying driver, the blockchain. One blockchain powered startup, COTI is working on a cryptocurrency uniquely designed to process peer-to-peer transactions–much like the original vision of Bitcoin’s creator, Satoshi Nakamoto. Their objective is to create a digital decentralized coin that will address some of the frequently cited concerns of businesses who refuse to take cryptocurrencies as a medium of payment.

The Tortoise and the Hare Doesn’t Apply to Blockchain

On average, it takes about ten minutes to mine a bitcoin block. Data from blockchain.info demonstrates that the average blockchain transaction–across all public chains–isn’t any better. Additionally, it is recommended that users wait about six blocks before considering a transaction as “confirmed”. Simple math shows that on average, a bitcoin transaction takes sixty minutes to process from start to finish. Other times, it can take up to sixteen hours to mine a single block. In these cases, businesses can hardly be blamed for not accepting crypto payments. Right now, cryptocurrency transaction speeds pale in comparison to standard credit cards, which are capable of handling thousands of transactions per second?

In response, COTI is developing a decentralized network that will be able to process 10,000 transactions per second, as well as provide instant confirmation time. Their distributed ledger technology uses what’s called a directed acyclic graph (DAG) data structure to process transactions in an extremely efficient manner. A key feature of this network is its inherent scalability. As more users participate in the network, network speed and efficiency increases. The COTI blockchain attains genuine decentralization without neglecting scalability and security.

Cryptocurrency Volatility Could Be a Good Thing… Just Not for Merchants

Another top concern for merchants is cryptocurrency volatility. For example, bitcoin had a daily volatility of 5 percent in 2017. Businesses want no part in these dramatic price swings, especially retailers whose margins are already thin. In a sort of catch-22, consumers also don’t want to spend their Bitcoins. As the Oracle Times notes, “many investors will agree that Bitcoin and other leading cryptocurrencies have become more of an asset than a currency… Bitcoin’s value is frequently changing, [so] most Bitcoin owners can make profits by selling their coins when prices are high and buying more when prices are low.” Understandably, many Bitcoin buyers are hesitant to spend their digital coins, created a “demand vacuum” for both merchants and customers.

In an attempt to address these issues, the COTI team is creating a COTI-denominated derivatives market that supports options and forwards contracts. Any users, whether merchants or buyers, will be able to hedge their COTI positions and essentially “lock in” coin prices. Purchasing power on the COTI network has the potential to remain relatively stable, giving merchants the peace of mind that newly received coins won’t plummet overnight. Likewise, the hedging factor of the network should help disincentivize wild speculation.

Another unique feature of the network is the global Trust Scoring Engine (TSE). The TSE assigns each network participant–both end user and merchant–a unique Trust Score based on account history, dispute occurence, dispute record (wins vs. losses), and user ratings. The TSE creates an objective user evaluation metric that doesn’t rely on sensitive private data, unlike a traditional credit score.

The TSE is also used to determine COTI transaction fees, establishing a good behavior incentivization program. Merchants and buyers with clean histories will pay less in fees than dishonest and manipulative ones. This feature should help lower the average cost per transaction for both parties, which for mainstream cryptocurrencies like Bitcoin have been sky high in the past.