Bitcoin tracks macro moves, amplifies downturns, and lacks structural leadership in the current cycle.

Crypto markets continue to trade within a broader risk-driven environment. Price swings remain tied to macro conditions rather than internal momentum. Bitcoin still reacts to equity moves instead of setting its own pace. According to recent analysis, structural strength has yet to return.

BTC Lacks Independence From Stocks as Investors Pull Capital

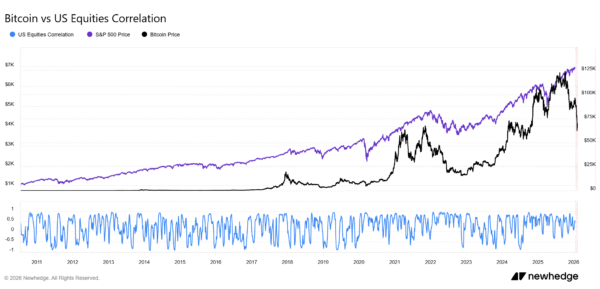

Bitcoin still moves partly with the stock market. Over the past month, its connection with the S&P 500 has been moderate, not very strong, but not independent either. That means Bitcoin is not acting like a safe asset that moves on its own. Instead, it is still influenced by the same economic pressures that affect stocks.

During market stress, when stocks or metals begin to decline, Bitcoin responds more aggressively. Small declines in traditional markets can lead to larger percentage losses in BTC.

Moreover, price action across major assets reflects a cautious environment. Bitcoin’s 30-day rolling correlation with the S&P 500 sits near 0.25. While the S&P 500 trends upward and gold holds strength, Bitcoin does not move much. It does not rise strongly or attract fresh momentum. Instead, the asset trades sideways or drifts slightly lower.

Image Source: Newhedge

Recent Bitcoin ETF data also shows similar weakness. On February 12, investors withdrew $410 million from spot Bitcoin ETFs, while none of the 12 funds received new funds. That means money flowed out of Bitcoin ETFs, with no offsetting inflows into other Bitcoin-based offerings.

Looking at how Bitcoin moves compared to the stock market also helps explain things. The relationship between Bitcoin and the S&P 500 is not particularly strong, but it is still evident. In simple terms, Bitcoin is not fully independent. It continues to respond to developments in the broader crypto market.

Altcoin Recovery in Doubt as Bitcoin Struggles to Lead

Bitcoin is also not behaving like a “safe haven” asset, such as gold, which investors often buy during uncertainty. Instead, it continues to behave as a risk asset. When broader markets experience pressure or fear, Bitcoin usually does as well.

Volatility indicators are beginning to turn higher again. Data from the Bitcoin Volatility Index shows a 30-day volatility estimate of around 2.20%, while the 60-day reading stands near 1.88%.

Recent compression of price swings indicates short-term stabilization. However, the renewed uptick suggests expectations of wider price movements ahead. Such increases in volatility are associated with uncertainty and repositioning.

If BTC fails to show structural strength, smaller tokens face steeper odds. According to the market analyst, as many as 95% of altcoins may never reclaim former peaks.

He said the recent weakness does not signal the end of the cycle or an imminent collapse. However, he argued that until BTC outperforms or demonstrates relative strength, any upside should be viewed as a technical rebound.

The situation, if you look at it without bias, is almost ironic in how simple it is to read.

When $SPX, gold and silver rise, Bitcoin does not react strongly. It does not accelerate, it does not show leadership. It stays there… flat, often with a slight downward slope. It's as…

— EliZ (@eliz883) February 12, 2026

In his view, sustained leadership and resilience are needed to confirm a stronger trend. The analyst added that crypto cycles remain intact and that another expansion phase is likely to follow over time.

For now, he advised market participants to manage risk carefully and preserve capital while waiting for clearer signs of trend reversal.