Key Insights:

- Ethereum is becoming highly attractive to corporate investors all over the defi space.

- ETF interest is also on the rise with nearly $1 billion in inflows recorded on Wednesday.

- Ethereum is increasingly being predicted to reach the $30k mark soon.

Ethereum is riding a wave of bullish momentum after spot Ether ETFs in the U.S. recorded their highest single-day inflow of nearly $727 million.

This surge is not only pushing ETH’s price past major resistance levels: It’s also on the verge of kickstarting an altcoin season, alongside sky-high open interest in Ethereum futures. Altogether, the crypto community is beginning to set massive price targets as high as $30,000 for Ethereum, and here’s what to keep in mind.

Record-Breaking ETF Inflows Show Institutional FOMO

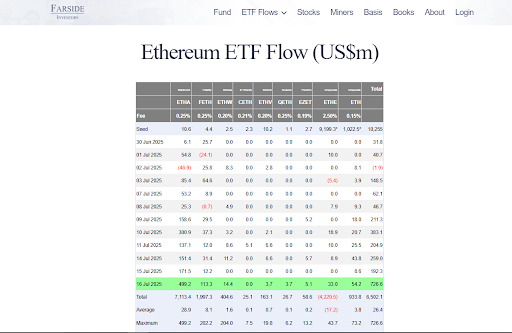

On Wednesday 17 July, U.S. spot Ether ETFs brought in a staggering $726.6 million. This enabled them to smash the previous daily inflow record of $428 million from December 2024, by almost 70% according to Farside Investors.

The largest contribution came from BlackRock’s ETHA fund, which alone saw a $499 million inflow. Fidelity’s FETH ETF followed with $113 million.

With this, spot Ether ETFs now hold over 5 million ETH, and account for more than 4% of Ethereum’s total circulating supply. This buying spree marks an extremely bullish change in perspective from institutional investors, who are now raking in ETH at much higher rates than the network’s issuance.

For context, on the same day, Ethereum’s network only issued about $6.74 million worth of ETH. This means that the ETFs bought nearly 107 times more ETH than was created.

Ethereum Price Surges as Altcoins Join the Party

ETH is currently trading at around $3,346 according to CoinMarketCap, after gaining 7.2% in the last 24 hours and over 30% in the past two weeks. This breakout above the $3,000 mask is now being seen as a launchpad for even higher prices.

As Ethereum gains momentum, altcoins are heating up as well. In the last 24 hours, XRP rose 7.6%, BNB gained 3.4%, Solana climbed 5.2%, Dogecoin jumped 6.9% and Tron (TRX) moved up 3.2%.

On the other hand, Bitcoin increased by just 0.7%, and its market dominance now hovers around 61%.

According to insights from Crypto analyst Matthew Hyland, if Ethereum’s run continues, Bitcoin dominance may have already peaked. In essence, an altcoin season may have already started.

Corporate Accumulation of Ethereum Hits $5.3 Billion

It’s not just ETFs getting in on the action. Corporate treasuries are also loading up on Ethereum. As of now, companies collectively hold over $5.33 billion in ETH, which amounts to roughly 1.33% of Ethereum’s total supply according to the Strategic ETH Reserve.

One of the most aggressive buyers has been SharpLink Gaming, which purchased $68 million in ETH in the past 24 hours and $343 million over the last eight days. Trump-affiliated World Liberty Financial also bought an additional $5 million worth of ETH above its average acquisition price.

Finally, BitMine Immersion Technologies, chaired by Fundstrat’s Tom Lee now holds over $500 million in ETH in its reserves. This corporate enthusiasm is very similar to trends seen with Bitcoin in previous cycles and shows a rising belief in Ethereum’s long-term value proposition.

Can ETH Hit $30,000?

Traders and analysts are starting to revise their price predictions for Ethereum, considering its recent performance. According to insights from trader DeFi Dad, ETH could top out between $15,000–$30,000 this cycle.

He said:

“I am buying and holding ETH, believing we can run at minimum to $15K–$18K (20x from its low in 2022, 5–6x from here).”

Other analysts are also comparing ETH’s current cycle to its 2016–2017 performance, and are looking towards a possible 330% move from the April low of $1,400.

I’ve completely readjusted my expectations for $ETH this run to top out between $15k-$30k.

I am buying and holding ETH believing we can run at minimum to $15k-$18k (20x from its low in 2022, 5-6x from here).

This is the worst case atm.

When you add in all the tailwinds of… https://t.co/P7YaNfbuX4

— DeFi Dad ⟠ defidad.eth (@DeFi_Dad) July 15, 2025

That could push the price up to $6,000 or higher, with even the most conservative analysts eyeing $4,000 as the next major milestone.