Bitcoin ATMs appear in Nairobi malls days after Kenya’s new VASP law took effect, creating a stress test for regulators who have yet to issue licenses.

Kenya implemented its first comprehensive cryptocurrency law recently. Bitcoin ATMs have been seen in major shopping malls in Nairobi. This sudden appearance puts an immediate stress test on regulators. Authorities say that no crypto provider has been authorized to work under the new framework yet.

Regulatory Bodies Issue Strong Public Warning on Licensing

Local media reports confirm that new machines were put into place. There are now several major malls in Nairobi that are hosting the kiosks branded as “Bankless Bitcoin.” These devices are installed beside conventional banking kiosks. Therefore, they provide cash-to-crypto services to the local citizens. This is not the first time that such infrastructure has come up, but these are more visible.

Related Reading: Crypto News Today: Kenya Parliament Approves Crypto Regulation Framework | Live Bitcoin News

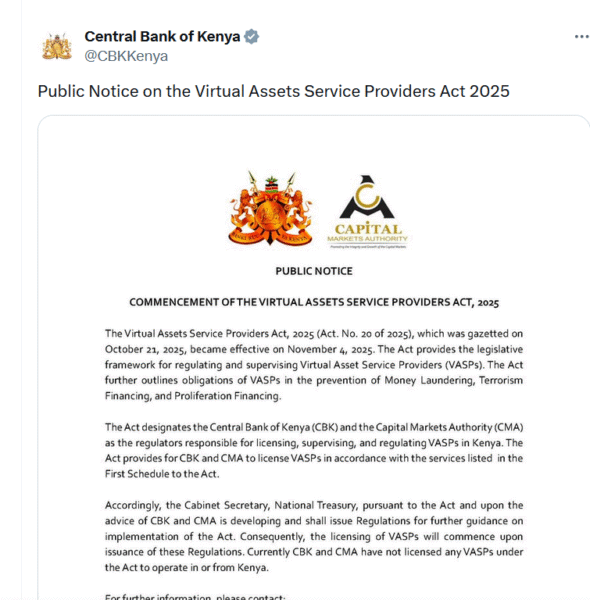

The new Virtual Asset Service Providers (VASP) Act came into effect on November 4, 2025. In a joint public notice, the Central Bank of Kenya (CBK) and the Capital Markets Authority (CMA) were quick in responding. The law provides a formal framework for the regulation of service providers of virtual assets. In addition, it has strict obligations as regards anti-money laundering and terrorism financing prevention.

The Act makes the CBK and CMA joint regulators of the sector. They shall be shared in the licensing, supervision, and regulation of all VASPs in or operating from Kenya. The National Treasury is currently preparing detailed regulations in order to put the new law into practice. Thus, the licensing of providers will only begin with the issuance of these final rules.

However, in spite of the entrance of the stake Bitcoin ATMs, the regulators put strong warning. Their public notice on November 18 confirmed that no operator has been formally approved to date. In regard to this, the CBK and CMA warned that any firm that claims to be licensed is doing so illegally. The new law aims to make Kenya a regional fintech hub.

Grassroots Crypto Adoption Paves the Way for Formal Market

While the mall installations are aimed at the formal retail economy, the circulation of Bitcoin already exists in other places. Grassroots use of cryptocurrencies has been going on in lower-income neighborhoods like Kibera for years. Indeed, this virtual borrowing presents the actual use of the technology. The community-based projects are evidence of the strong existing demand.

In the village of Soweto West, in the Kibera area of Kenya, a Kenyan fintech startup began an effort. Afrobit Africa went for Bitcoin-denominated grants in 2022. This project aimed at local garbage collectors who did not always have bank accounts or even ID. As a result, the digital currency presents a path towards financial freedom to these residents.

Africa estimates that they have injected roughly $10,000 into the community through these grants. The workers are paid in a few dollars in bitcoins rather than shillings after clean-ups. Moreover, it is estimated that the number of people in Soweto West using the digital currency now stands at around 200. A few merchants and motorcycle riders also accept crypto.

The Lightning Network has enabled these small transactions. This technology enables near-free instant payments in the community. Furthermore, some residents favor using Bitcoin over Kenya’s dominating mobile money system, M-PESA. They mention high transaction fees and sometimes delays in the telco network.

Ultimately, the new Bitcoin ATM installations and the VASP Act are a critical time. The state is on its way to control a sector that already has decent signs of organic growth. Therefore, it presents a challenging task for regulators to balance between stability and compliance and promote this innovation.