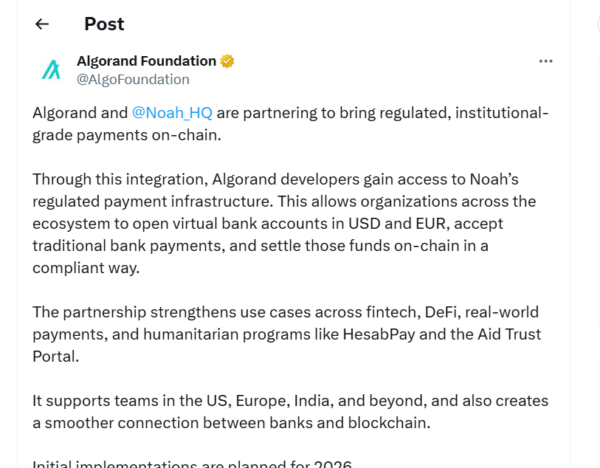

Algorand and Noah have partnered to deliver institutional-grade, regulated payment infrastructure on-chain. This key integration allows Algorand businesses to access virtual USD and EUR bank accounts.

In a significant move, Algorand and Noah are partnering to bring regulated, institutional payments onto the blockchain. This integration gives Algorand developers access to Noah’s robust and regulated payment infrastructure. Consequently, the whole eco-system becomes more appealing for builders.

This partnership is much more important than many observers realize. Noah is not a regular crypto project. It is a regulated digital banking organization. Specifically, Noah provides actual virtual bank accounts to businesses worldwide.

Regulated Accounts Breakdown Five Adoption Barriers

This new infrastructure has allowed companies using Algorand to open bank accounts directly. These accounts are completely connected with the blockchain network. This is a pivotal change where traditional finance is truly integrated with Web3.

Related Reading: Crypto News: SG-FORGE Issues First U.S. Blockchain Bond on Canton Network | Live Bitcoin News

The most important advantage is that businesses on Algorand can now accept traditional bank payments of USD and EUR. Furthermore, they can settle the received funds on-chain in a fully-compliant manner. This enables the seamless movement of fiat money and crypto assets.

The integration eliminates five big barriers to institutional adoption at a time. It negates the need for complex, third-party processors of payment processors. Instead, compliance and enterprise onboarding are seamlessly built into the process.

This development places Algorand where it performs best. It crystallizes the identity of the network as the institutional-grade financial layer. This infrastructure is vital for world commerce.

Algorand has existing advantages in the enterprise sector. The network boasts extreme speed as well as instant finality. Additionally, it has a very sustainable consensus mechanism. This makes it suitable for major government and enterprise use cases.

Algorand Strengthens Banking-to-Blockchain Connectivity

The partnership gives a strong boost to the use cases for different sectors. It supports real world payments, decentralized finance (DeFi), fintech platforms. The integration will also be beneficial to humanitarian programs such as HesabPay and the Aid Trust Portal.

The bigger story is the direct flow of USD and EUR settlements over the Algorand chain. This means that real-world financial value is now moving around the network. Ultimately, the collaboration has teams in the US, Europe, and India.

The partnership also provides for a smoother and more efficient connection between banks and blockchain systems. This is a vital step since the future is emerging as an inter-connecting of institutional networks.

However, the full impact will take time to materialise. Initial implementations across the Algorand ecosystem are scheduled for 2026. This launch will further cement the competitive advantage of the network.

The collaboration helps create compliant real-world financial products. These products include lower costs and increased regulatory confidence. Therefore, this move is a huge leap for institutional on-chain banking.

Ultimately, this partnership brings Algorand closer to being adopted in reality on an institutional level. In addition, it relates traditional banking to blockchain in a practical manner. It also allows for the smooth USD and EUR settlements on-chain. As a result, developers can be more powerful in their tools. Ultimately, the alliance helps with accelerated growth and expands the use cases for financial applications in the real world.