Coinbase Derivatives will launch 24/7 futures for major altcoins on Dec 5. This expands continuous trading beyond BTC and ETH for US traders.

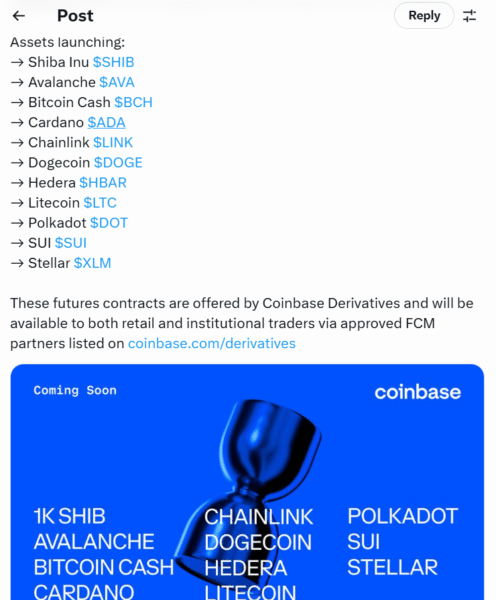

Coinbase Derivatives plans a significant expansion. Specifically, they will be expanding the 24/7 trading of their listed altcoin futures. Indeed, these are Avalanche, Bitcoin Cash, Cardano, Chainlink, Dogecoin, Hedera, Litecoin, Polkadot, Shiba Inu, Stellar, and SUI. This move represents a significant improvement in their offerings. It satisfies the increasing market demand.

Nonstop Trading for Key Altcoins Goes Live December 5

Non-stop trading for these assets will begin on December 5. Therefore, this information is from a Coinbase post by Coinbase Markets. Consequently, this contributes to Coinbase Derivatives already having 24/7 support. This current support has already proven popular amongst traders.

Related Reading: Crypto News: Coinbase to Launch New ‘DeFi Mullet’ Offering in Brazil Soon | Live Bitcoin News

Furthermore, this existing support is for Bitcoin, Ethereum, Solana, and XRP products. Notably, it includes nano as well as “perp-style” futures products. This is a huge step for opening the market. It offers more opportunities for active portfolio management.

December 5 marks a key date. Specifically, 24/7 trading launches for all alt coin monthly futures. These are offered by Coinbase Derivatives. December 12 will see new US perpetual style futures to be launched. This applies to all altcoins. This staggered launch is to ensure smooth integration.

Assets launching include Shiba Inu ($SHIB), Avalanche ($AVAX), Bitcoin Cash ($BCH), Cardano ($ADA), Chainlink ($LINK), Dogecoin ($DOGE), Hedera ($HBAR), Litecoin ($LTC), Polkadot ($DOT), SUI ($SUI) and Stellar ($XLM). This extensive list includes a lot of top-tier altcoins.

These futures contracts are available from Coinbase Derivatives. Furthermore, they will be available to retail and institutional traders. This access is offered through approved FCM partners. This widespread availability democratizes sophisticated financial instruments.

Coinbase’s perpetual-style contracts for the US market are different from the traditional perpetuals. In fact, they have a lifespan of five years. Traditional perpetuals do not typically expire. This structure provides a unique benefit for risk management purposes.

Coinbase’s Expanding Derivatives Foothold in the US Market

This strategic move is aimed at the continuous nature of the cryptocurrency market. Moreover, it lets the U.S. traders handle risk well. They can also trade in response to market events that occur outside of traditional trading hours. This flexibility is important in volatile crypto markets.

Coinbase provides as much as 10x leverage for its perpetual futures. Therefore, this enables traders to magnify their positions. This high leverage can result in high gains or losses. It attracts the experienced traders.

According to Coinbase, the global crypto derivatives market is huge. Crucially, it is a substantial portion of global crypto trading volume. This implies that there is high demand for such products. The expansion is aimed directly at this demand.

In addition, Coinbase’s CFTC-regulated derivatives arm has been up and running. Specifically, this revealed Bitcoin and Ethereum futures trading 24/7 in May. Perpetual-style futures were introduced in July. These previous launches made important groundwork.

These product launches were immediately following a major acquisition. Indeed, Coinbase’s historic $2.9 billion acquisition of Deribit was completed. This greatly increased its derivatives capabilities. This acquisition was a power play calculated for the long term.

Ultimately, this move by Coinbase represents a broader trend. Institutional and retail investors look for more regulated crypto products. The availability of 24/7 altcoin futures will likely increase liquidity. It will also enhance the process of price discovery for these important digital assets. This further helps embed crypto into the mainstream financial landscape.