Monero (XMR) is confirming a crucial support point following the drop amid rate-cut volatility. Will the existing wedge pattern lead to a bullish recovery?

Monero (XMR) fell hard in the recent crypto volatility spike, as markets responded to key events in the world.

The move by the Federal Reserve to reduce interest rates and a high-profile meeting between Trump and Xi Jinping had triggered $813 million in liquidations, with Bitcoin and Ethereum falling more than 3 percent.

This put further pressure on Monero, plummeting down into a zone that is now testing critical support of around $322 to 328.

The falling intensified as XMR approached the lower end of the wedge following its resistance on the level of $345.90.

Spot trading is still intense as buyers attempt to support the $328 area- a price that the bulls have been defending on numerous occasions.

Will the Wedge Trigger a Reversal?

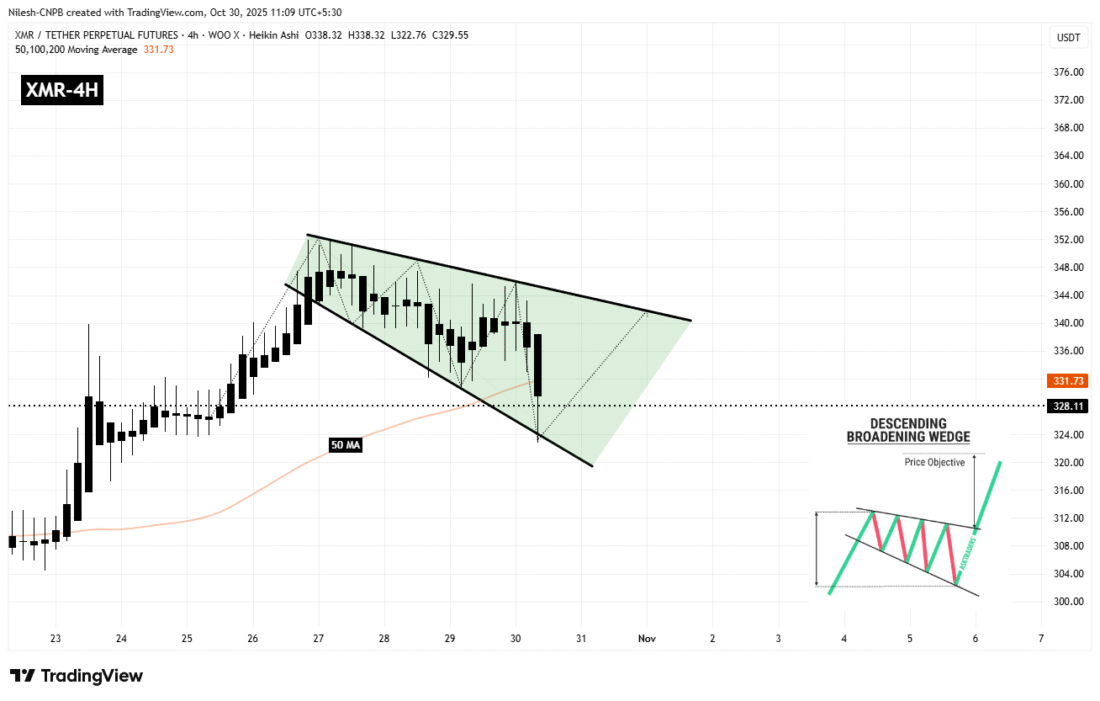

According to the TradingView charts of Coinsprobe, XMR is in a developing broadening descending wedge, the classic reversal indicator in technical analysis.

Monero (XMR) 4H Chart/Coinsprobe (Source: Tradingview)

The trend shows a widening volatility as the sellers are losing control, which opens room for a bullish recovery.

The bottom of the wedge is at 322 support, and the 50-hour moving average is at almost 331.73, which is a key pivot in the short term.

According to CoinMarketCap market watchers, the ability to maintain this range would act as a catalyst for the new momentum.

In case bulls maintain the lower limit and advance beyond the 50-hour moving average, XMR would be able to recover to the 342 level.

The break of above $342 would affirm the bullish wedge and roll out the gate of the dependable recovery in the next few days.

Recent price fluctuations indicate that in the short term, the price may range between 321.17 and 333.21, and in the medium term, Changelly predicts that prices can go higher than 350 when the overall sentiment is balanced.

CoinCodex rates XMR sentiment at bullish, with 63 percent positive trading days and a volatility rate of 4.37 percent.

Cautious Optimism as Bulls Hold the Line

Various analysts believe that the Monero range of $322 to $328 will serve as the dynamic support. In case sellers surpass buyers in this area, Monero will face greater declines and increase the insecurity of privacy token owners.

On top of the technicals, the privacy story underpins the resilience of XMR amid delisting and scrutiny.

The long-term projections may give bullish predictions on XMR in November. Those analysts expect a potential jump to over $350 in case important levels are maintained.

The lower edge of the wedge is the focal point in a trend reversal because traders estimate the strength of buyers in the next few hours.