American Bitcoin’s stock plunged over 50% after a lock-up expiration. The fall wiped out gains and signals renewed crypto market stress.

The mining and Bitcoin-treasury company co-founded by Eric Trump saw its stock plunge. The price is reduced by over 50% in the first hour of trading. This caused several interruptions. As a result, the crash erased months of speculative gains.

Lock-Up Expiration Triggers Mass Selling Wave

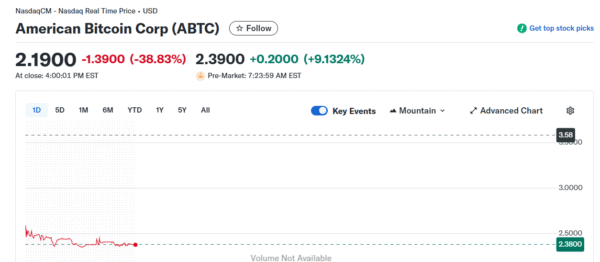

The company, which is listed on the Nasdaq exchange under the ticker symbol ABTC, had already been reeling. This was because of the steep pullback of Bitcoin over the last month. But the velocity of Tuesday’s sell-off surprised even long-time followers of crypto-equity developments. Shares fell to an intraday low of $1.75. This represented a 45% drop.

Related Reading: BTC News: Bitcoin Hits $93K, Eyes Set on $100K Mark | Live Bitcoin News

The stock stabilized somewhat after this. The stock is currently down more than 38% at the time of writing. The sell-off was triggered on the second of Dec 2025. A shareholder lock-up period was over. This provided the opportunity to trade restricted shares.

Shares from a private placement were trading on an exchange. These stocks were issued before American Bitcoin’s merger with Gryphon Digital Mining Inc. This was the eligibility that caused a spurt of selling pressure. This massive rush of shares flooded out buyers.

The stock plunge came amid a general crypto market downturn. This downturn has witnessed the fall of Bitcoin from its October high. This larger picture made the company’s losses even more acute.

Broader Market Weakness Contributes to Price Plunge

No one headline, however, set off the avalanche on Tuesday. But market conditions were brittle already. A day before, close to $1 billion of leveraged crypto positions were liquidated. Bitcoin had crashed to the mid-$85,000s.

While the larger marketplace was brittle, no one headline triggered Tuesday’s avalanche. The sharp and large decline in price, in addition, caused several trading halts. These halts are a standard protocol. They are intended to cool down excessive volatility on markets.

The stock was already under previous pressure. It dropped 55.49% for the last month alone. It also declined by 61% in the last six months. This prolonged decline exhibits a specific lack of sustained investor confidence.

Other crypto-related ventures that have been connected to the Trump family have also experienced heavy losses in late 2025. This signals an expanded repricing of political and crypto-adjacent assets.

Therefore, when coupled with technical selling from the lock-up expiration and the general weakness in the market, it proved devastating. The event brought into focus the extremely leveraged nature of crypto-linked equities. They have the benefit of often amplifying moves in the asset on which they are based.

The steep drop signals the concerns of investors about where the crypto market is moving forward. The ongoing fluctuations in the price of Bitcoin have a direct impact on the profitability of Bitcoin mining companies such as ABTC.

As a result, this massive stock crash is a great cautionary example. It gives a word of caution on the risks involved in holding crypto-treasury stocks. These companies are still subject to the fluctuations of both the equity and the digital asset markets.

Observers will now watch the stock closely for indications of a floor. Furthermore, the outcome would affect the sentiment for other publicly traded crypto firms. This event illuminates the vulnerability of these business models.