Key Insights:

- Bitfinex analysts recently pointed out that a Bitcoin pump is unlikely anytime soon due to cooling spot trading volume and weakened taker buy pressure.

- Despite slowing spot activity, US-based spot Bitcoin ETFs have seen 14 consecutive days of net inflows.

- The upcoming Federal Reserve interest rate decision on July 30 will be a massive macroeconomic factor to watch out for.

Bitcoin’s rally through the first half of the year has been impressive. However, recent data shows that the momentum just might be cooling.

According to analysts at Bitfinex, there are now ongoing signs of consolidation. Because of this, the chances of another massive upward move are disturbingly low.At least for now.

Bitcoin registered a $107,000 monthly close in June, with its price action being historically strong. However, beneath the surface, metrics like spot trading volume, ETF inflows and long-term holder behavior are starting to shift.

These small changes could redirect the future of the crypto market over the coming weeks, and here are the details to keep in mind.

Signs of Slowing Momentum

According to its latest markets report, Bitfinex pointed out that Bitcoin’s powerful uptrend was driven by institutional inflows and macroeconomic optimism.

However, all of this is starting to lose steam.

“Spot volume has cooled, taker buy pressure has weakened, and profit-taking has intensified,” the report noted. Much of that selling is coming from short-term holders who entered the market below $80,000 and are now securing gains. This trend doesn’t necessarily show that a reversal is incoming.

Still, it does show Bitcoin may be getting ready for some sideways trading or mild retracement.

According to Bitfinex, this is more of a “transition phase” than a breakdown. Still, the reduced trading activity makes it less likely that Bitcoin will launch into another explosion upwards soon.

Bitcoin ETF Inflows Still Strong, But Can They Keep Up?

Despite the slowing spot market activity, institutional demand has still been a bright spot.

U.S.-based spot Bitcoin ETFs have seen 14 consecutive days of net inflows worth $4.63 billion as of June 27. According to Economist Timothy Peterson, last week’s $2.2 billion inflows was “massive,” and the streak will likely continue.

“There’s a 70% chance next week will be positive too,” he said.

Massive inflows into US Bitcoin ETFs last week!

$2.2 billion!

This ranks among the top 10 weeks since inception.

70% chance next week will be positive too, which generally correlates to upward price pressure. pic.twitter.com/m8x9SY9Dvo— Timothy Peterson (@nsquaredvalue) June 29, 2025

In essence, continued inflows are still very important for balancing out the recent selling pressure from both short-term and long-term holders. If ETF demand weakens, Bitcoin’s support above the $100K level could be tested.

All Eyes on the Fed

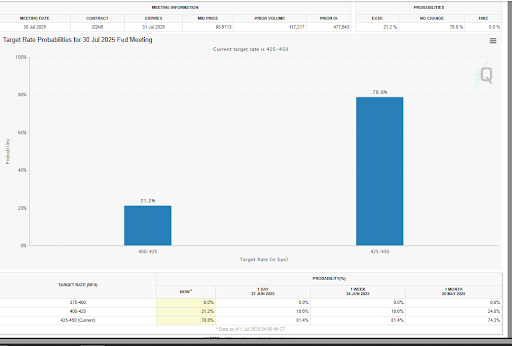

Another major factor in Bitcoin’s next move will be macroeconomic policy, especially the upcoming Federal Reserve interest rate decision on July 30.

Lower interest rates are generally bullish for risk assets like Bitcoin, considering how they make borrowing cheaper and reduce the appeal of traditional assets. As of now, there is only a 21% chance that the Fed will cut rates at the July meeting, according to CME Group’s FedWatch Tool.

Still, any dovish comments or signs of future easing could inject fresh energy into the Bitcoin and crypto markets.

Bitcoin July’s Historical Strength

Despite the current market indecision, Bitcoin’s June close stands as its highest ever monthly close around $107,000. This also marked the third consecutive green monthly candle this year, and has contributed to its strong rebound from the April low of $75,000.

However, technical analysts were quick to point out that the June candle formed a spinning top pattern.

Think of a Spinning Top as a kind of candlestick with a small body and long wicks. This pattern shows that traders are indecisive, and neither bulls nor bears are in control.

It is worth mentioning that a similar pattern appeared in July 2024 and was followed by an 8.6% price drop the next month.

Overall, while history doesn’t always repeat, traders are watching closely. Investors are advised to approach the Bitcoin market with caution, especially now in July.