Ethereum whales and institutions buy the dip as a dormant wallet adds $28M in ETH, hinting at potential recovery strength.

Ethereum whales appear to be back in business, after a wallet that had been silent for the last four years resurfaced.

The address withdrew 6,334 ETH worth around $28 million from Kraken earlier this week. The move came as Ether’s price dropped 13% from over $5,000 to near $4,315, which makes it a well-timed entry at lower levels.

Growing institutional and whale demand for ETH

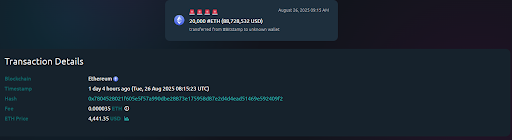

Aside from the initial whale movement of $28 million from Kraken earlier in the week, Data from Whale Alert showed that Bitstamp transferred a staggering 20,000 ETH to an unknown wallet. This is another sign of self-custody and confidence in future price gains.

Arkham Intelligence even revealed that one whale purchased and staked around $2.55 billion worth of Ether via Hyperliquid on Monday.

Overall, whale activity is not the only factor fueling demand.

Crypto mining and investment firm BitMine has been aggressively adding to its Ethereum holdings. The company accumulated $252 million in ETH over the past week, and lifted its total stash to about 797,704 ETH. So far, the company holds Ethereum with a value near $3.7 billion.

BitMine still has $200 million reserved for more purchases, which shows its strong commitment to the asset.

At the same time, spot Ethereum ETFs have attracted more than $1 billion in inflows since August 21. That surge almost erased the $926 million in outflows seen only four days earlier. This indicates that institutional investors are also buying the dip.

Rotation from Bitcoin strengthens Ethereum’s case.

Analysts are also noting that Ethereum is benefiting from general market rotation. Investors are locking in profits from Bitcoin’s run to new highs, and funds are moving onto ETH and other altcoins.

Arkham data also shows that nine large wallets bought a combined $456 million in Ether from Bitgo and Galaxy Digital. Crypto analyst Willy Woo even reported that Ether inflows, at $900 million per day, are approaching Bitcoin’s inflows.

9 WHALE ADDRESSES JUST BOUGHT $450M OF ETH

9 massive addresses just bought a total of $456.8 MILLION USD of ETH. 5 of these addresses received from Bitgo while the remainder purchased their ETH with Galaxy Digital OTC.

Whales are buying $ETH.

Addresses:… pic.twitter.com/TceZQlng6w

— Arkham (@arkham) August 26, 2025

Particularly, Nansen data also showed that “smart money” traders are expanding into other tokens like Chainlink (LINK), Ethena (ENA) and Lido DAO (LDO). However, the amounts are still small compared with the recent inflows into ETH.

Ethereum price outlook

As of writing, the whales, institutional players and ETFs are all adding massive amounts of Ether to their holdings, and sentiment is moving toward fresh optimism.

The ongoing combination of heavy whale buying, rotation from Bitcoin and recovery in the charts is now giving strength to Ethereum’s bullish narrative.

If the ongoing trends hold, Ethereum could end the year as one of the strongest-performing assets in the digital space.

What remains now is whether the sustained buying pressure and on-chain accumulation will continue to offset volatility over the short term