Key Insights:

- The Bank for International Settlements (BIS) argues that stablecoins “fail as money”.

- Stablecoins lack “singleness,” “elasticity,” and “integrity,” making them vulnerable to criminal misuse.

- The BIS warns that stablecoin adoption could threaten monetary sovereignty and financial stability.

For a long time, Stablecoins have been promoted as the ultimate bridge between traditional finance and digital assets. However, a recent report from the Bank for International Settlements (BIS) has strongly pushed back against this narrative.

According to its 2025 Annual Economic Report, the BIS stated that stablecoins “fail on multiple counts” when it comes to its role as money. Not only this, the bank also states that stablecoins also pose major risks to financial stability, integrity and monetary sovereignty.

Here’s what the BIS believes is wrong with stablecoins.

Stablecoins Fail Monetary Tests

In the report, the BIS measured stablecoins against three criteria that define money today. According to the bank, these three criteria include singleness, elasticity and integrity. Stablecoins, as it turns out, perform “poorly”.

“Stablecoins perform poorly when assessed against the three tests for serving as the mainstay of the monetary system,” the report concluded.

According to the report, “singleness” points towards the idea that money must be universally accepted at face value. Central bank money, like cash or reserves, fulfills this by default.

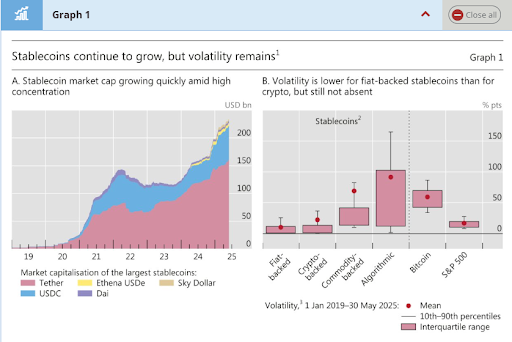

Stablecoins, on the other hand, are issued by private entities and do not always maintain a fixed exchange rate: Even if they are pegged to a fiat cryptocurrency.

According to Hyun Song Shin, BIS’s Economic Adviser, this breaks the “no-questions-asked” principle that makes conventional money so effective. In other words, if the value of a stablecoin can fluctuate depending on its issuer or perceived stability (as seen in past failures like TerraUSD) it fails the first test of singleness.

Elasticity and Integrity

Stablecoins also fail the other two tests, according to the BIS.

Think of Elasticity as a monetary system’s ability to expand and contract its own supply in response to economic shocks. Central banks do this through monetary policy tools like interest rates or liquidity injections.

Stablecoins, on the other hand, need some serious upfront funding to achieve the same effect.

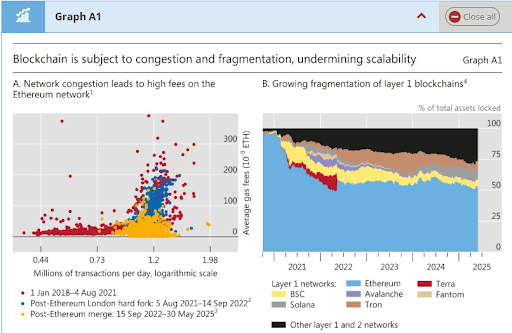

The BIS compared them to a rigid cash-in-advance setup, which cannot scale or contract in moments of crisis or heavy demand. This lack of flexibility makes them unsuitable as any part of the modern financial system. This brings us to Integrity, which is the biggest red flag, as far as the BIS is concerned.

The report alleges that stablecoins are often transacted through unhosted wallets on public blockchains. This makes them highly vulnerable to criminal misuse.

“Stablecoins have significant shortcomings when it comes to promoting the integrity of the monetary system,” the report noted.

Threat to Monetary Sovereignty and Financial Stability

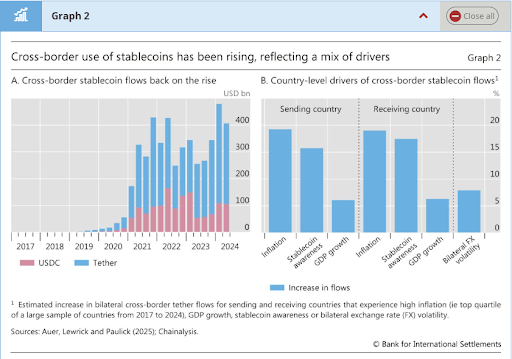

The BIS also warned that the uncontrolled use of stablecoins, especially across borders, could threaten the monetary sovereignty of smaller or developing economies. If citizens begin to favor dollar-pegged stablecoins over their national currencies, central banks may lose control over domestic monetary policy.

This is especially concerning for newer or smaller markets, where capital flight and inflation risks are already higher. Hyun Song Shin compared stablecoins to 19th-century U.S. private banknotes, which traded at different rates and caused economic instability.

In the BIS’s view, history shows that private money systems are prone to failure, and stablecoins are no exception.

Regulatory Action Is Urgently Needed

Given these findings, the BIS is calling for strict regulatory frameworks that limit the role of stablecoins. It warned against giving them the same level of trust or functionality as state-backed money.

“Society can re-learn the historical lessons about the limitations of unsound money,” the report said. “Bold action by central banks and other public authorities can push the financial system along the right path.”

The timing of this warning is especially interesting because just days before the BIS report was released, the U.S. Senate passed the GENIUS bill. If approved by the House, the bill could increase stablecoin usage across the United States and beyond.