BDACS deploys KRW1 on Polygon to enhance speed, transparency, and multi-chain stablecoin adoption across global payment ecosystems.

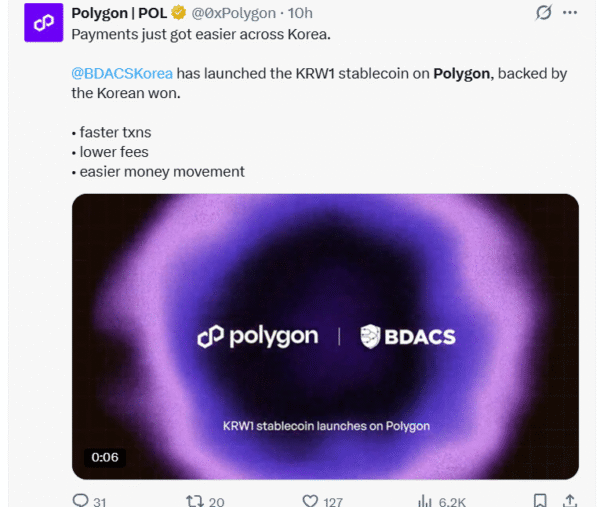

BDACS advanced its stablecoin strategy by launching the KRW-backed KRW1 token on Polygon. The move came amid a successful proof-of-concept to confirm that it could support stable and real-time performance from fiat deposits to on-chain settlement. Consequently, KRW1 will be able to enter one of the most widely adopted Web3 environments.

KRW1 Deployment Strengthens Multi-Chain Expansion Strategy

According to the news release, the move to Polygon greatly expands KRW1’s functionality in terms of payments, remittances, and enterprise systems. The high throughput and low fees that the network provides support for faster and more accessible stablecoin operations. Furthermore, according to the industry sources, KRW1 is still fully collateralized by reserves in Korea’s leading commercial institutions, such as Woori Bank, guaranteeing strict financial transparency.

Related Reading: Stablecoin News: South Korea’s KRW1 Stablecoin Integrates with Circle’s Arc Network | Live Bitcoin News

Additionally, the integration is in line with Polygon’s role as a core stablecoin environment. Polygon is continuing to work with large companies around the world, like Stripe, Circle, and Mastercard. These partnerships strengthen its institutional infrastructure and achieve reliable wallet, exchang,e and payment network interoperability. As a result, KRW1 will have instant access to a vast technological and commercial base.

Polygon’s Infrastructure Advances Institutional-Grade Stablecoin Adoption

Polygon executives said their deployment of KRW1 supports their vision of a resilient digital payments framework. They stressed that the operational stability, full tooling, and wide integration base of the network create the right conditions for the broad adoption of stablecoins. Moreover, Polygon growing involvement in tokenization tasks and payment inter-institution pilots makes it an ideal place to host regulated digital assets.

Industry commentators attributed the multiple chain roadmap to BDACS’s mission to improve liquidity, accessibility, and the usability of stablecoins across various blockchain systems. They pushed that the Polygon launch is a crucial step that could further speed the global positioning of KRW1, particularly as businesses investigate the financial infrastructure enabled by Web 3. This position is an expression of growing demand for quicker methods of lower-cost payments.

Analysts also paid attention to the transparency model of KRW1, which is based on real-time proof-of-reserves using a direct API connection with Woori Bank. This feature enhances accountability and brings BDACS complicit with the upcoming digital assets regulation in South Korea. Therefore, experts consider KRW1 as an instrument that is ready for compliance and readiness for more stringent supervision in light of the upcoming national frameworks. They further commented that these elements may help boost institutional confidence during the early adoption.

KRW1 Growth to Reshape Global On-Chain Payment Strategies

Furthermore, researchers singled out KRW1’s promise with cross-border remittances and public-sector distribution programs. Because the verification is done in real time, the token is potentially useful for the foundation of emergency-aid transfers, corporate settlements and international payroll flows. Due to this, BDACS’s Polygon expansion fundamentally supports a larger range of economic applications compared to previous generations of single-chain stablecoins.

Industry leaders called this launch a turning point for Korea’s digital finance industry. In particular, they noted that Polygon’s infrastructure is reliable: this enables KRW1 to scale to large volumes without sacrificing speed or cost efficiency. Additionally, experts anticipate the wider Asia-Pacific region to adopt the tools of stablecoins faster when multi-chain strategies mature.

The expansion may also cause competitive pressures throughout the regional stablecoin market. Networks that are based on more expensive fees or older settlement systems might face financial pressure as users move away from them towards faster alternatives.

Therefore, it was warned that weaker platforms would face restructuring or even liquidation if they were unable to match the efficiency of KRW1. As the adoption of KRW1 rises, its Polygon deployment could play a role in overall strategic decisions within the on-chain payment ecosystems around the world.