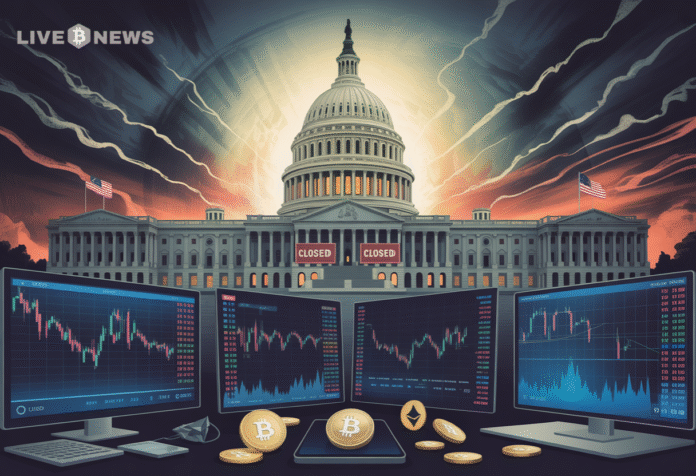

U.S. shutdown odds near 80% raise fears of a Treasury liquidity drain that could trigger sharp Bitcoin and altcoin selloffs.

The odds of a US government shutdown have skyrocketed. Polymarket now shows a probability of nearly 80% that government operations will halt by January 31.

This dramatic shift happened in just 24 hours. The prediction market previously priced shutdown odds at only 10-15%.

Crypto analyst Crypto Rover issued a stark warning on social media platform X. He called the potential shutdown “the biggest threat to crypto.”

🚨BIG WARNING: THE BIGGEST THREAT TO CRYPTO IS BACK.

The probability of a US government shutdown by January 31 has exploded to nearly 80%.

Just a day ago, it was only around 10%-15%.

And this is a serious liquidity risk for crypto.

Democrats have made it clear they will block… pic.twitter.com/QRyhpPPaGp

— Crypto Rover (@cryptorover) January 25, 2026

Senate Deadlock Pushes Shutdown Closer

The House passed a funding bill on Thursday. However, the Senate immediately blocked it over disputes regarding Department of Homeland Security provisions.

Democrats refuse to approve the bill without removing certain DHS funding measures. Republicans won’t budge on their position either.

Donald Trump weighed in on the standoff. He suggested politicians would likely force a shutdown without border funding provisions.

The January 30 deadline looms just five days away. Some observers believe a last-minute deal remains possible, but market sentiment suggests otherwise.

Liquidity Drain Could Devastate Crypto Markets

The shutdown threat poses serious risks for cryptocurrency markets. Crypto Rover explained that government shutdowns trigger specific market mechanics that hurt digital assets.

When shutdowns occur, the US Treasury rebuilds its Treasury General Account. This process pulls substantial liquidity from financial markets.

The last shutdown cycle saw the TGA increase by approximately $220 billion. That represented a massive liquidity withdrawal that crypto markets struggled to absorb.

Historical patterns show concerning trends. Markets initially pumped during previous shutdowns before liquidity evaporated. Bitcoin and Ethereum then dropped 20-25%. Altcoins suffered even steeper declines.

Current market conditions make the situation more precarious. Liquidity already runs thin across crypto markets.

Investor confidence remains fragile. Institutional money concentrates in stocks and gold instead.

Volatility has already spiked significantly. Crypto prices swing violently on relatively small capital flows.

Related Reading: Polymarket Odds Surge: 77% Chance of U.S. Government Shutdown Before January Ends

Top Traders Bet on Shutdown

Prediction market expert gavelsv highlighted unusual trading activity on Polymarket. The platform’s top traders have heavily positioned for a shutdown outcome.

US Government Shutdown will happen before Jan 31, cause this pattern never lies

When @Polymarket top traders all pile into the *same* market, that’s usually a huge signal

OUTCOME HAS ALREADY BEEN DETERMINED

> US Government Shutdown by January 31?

Top traders are leaning… pic.twitter.com/QgEAwQKM7l

— gavelsv.patron (@gavelsvtw) January 25, 2026

Three prominent traders lead the charge. Chungguskhan boasts $800,000 in profit. ImJustKen sits at $3 million. Betwick has earned $400,000.

Their combined profit and loss stands at $6.3 million. These traders rarely size into positions without extensive research.

Gavelsv noted that when top traders cluster on one side, it typically signals high conviction. The pattern suggests the shutdown may already be inevitable.

The debt ceiling was recently raised to $41.1 trillion. This ironically gives politicians more room to extend their standoff without immediate consequences.

For crypto holders, the next five days could prove critical.