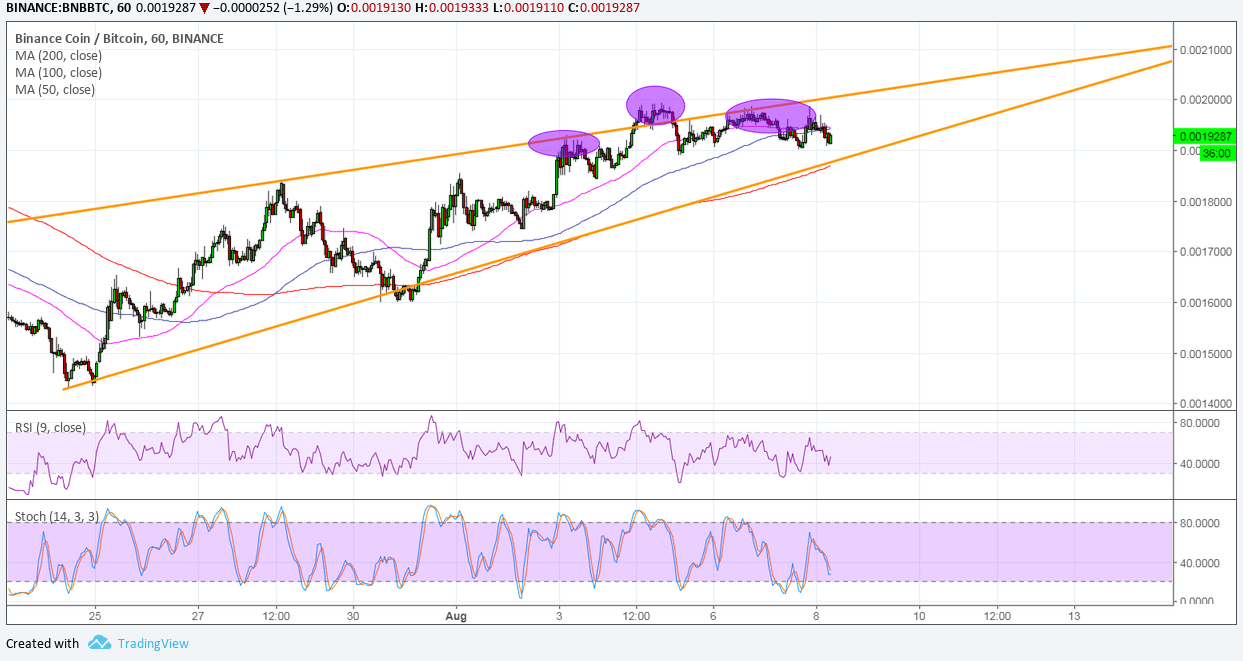

Binance is still consolidating inside its rising wedge pattern and appears to be bouncing off the top. In addition, a head and shoulders pattern appears to be forming right there, signaling that sellers are about to take over.

The 100 SMA is still above the longer-term 200 SMA, though, so the path of least resistance is to the upside. However, Binance is slowly moving below the 100 SMA as an early signal of a pickup in selling pressure. The 200 SMA dynamic inflection point lines up with the weged support at 0.0019 to add to its strength as a floor.

RSI is still heading lower to indicate that bearish momentum is in play and could be enough to take Binance to the very bottom of the wedge or perhaps a breakdown. Stochastic is also pointing down and has room to slide before hitting oversold levels. This means that selling pressure could stay in play for a bit longer.

Cryptocurrencies have been in the red for the past few days, yet Binance has been one of the few ones that managed to pare some losses, at least against bitcoin. The latter has been reeling from FUD and the spotlight returning to the SEC decision to delay their ruling on the bitcoin ETF applications from SolidX and VanEck.

With that, traders might have to wait until September to hear from the regulator about this decision, although their notice stated that they’ve received 1,300 comments in relation to the rule change. This could be an interesting next few weeks as traders wait with bated breath, as a denial could mean losses for bitcoin once more.

On the Binance side of things, there haven’t been much new updates on the exchange or the token itself, but it’s worth noting that UPBit was cleared after investigations. This lightened up the mood for crypto exchanges somewhat and their corresponding coins.