Binance stablecoin inflows broke above $1.6 billion, which indicates that traders are preparing for a market rebound.

Binance stablecoin inflows have risen past $1.6 billion, which is often regarded as a signal that traders are preparing to re-enter the crypto market. This large deposit comes amid recent volatility in Bitcoin and Ether and is happening as both assets are facing pressure from whale-driven selling.

Binance Deposits Mark Second Surge This Month

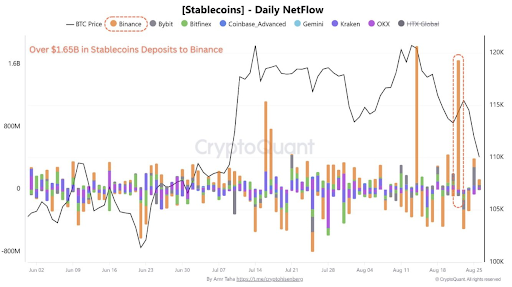

According to on-chain data from CryptoQuant, this is the second time in August that net stablecoin deposits on Binance have risen past $1.5 billion. Analyst Amr Taha described the trend as a “renewed wave of capital entering the spot market.”

This surge in inflows came during a general correction across the crypto space. Bitcoin briefly dipped below $109,000, while Ether gave back gains it had picked up after the Federal Reserve hinted at a possible rate cut in September.

Despite the slump, traders appear to be setting up for a possible rebound and have fresh capital waiting on the sidelines for the right opportunity.

$1B Ether Withdrawals Indicate Long-Term Holding

While stablecoins flowed into Binance, nearly $1 billion worth of Ether was withdrawn from the exchange. Large outflows indicate that investors are moving assets into private wallets for long-term storage.

This strategy reduces selling pressure on exchanges and shows confidence in Ether’s future value.

The mix of inflows and outflows also indicates that the market setup has become mixed. On one side, stablecoin deposits indicate that traders are preparing to buy. On the other hand, Ether withdrawals show that investors have a preference for holding rather than trading.

Together, these moves indicate that investors are waiting for the right moment to re-enter aggressively.

Binance Trading Volume And Its Dominance

The same day as these inflows happened, Binance processed more than $29.5 billion in trades according to CoinMarketCap. That figure was nearly six times higher than Bybit, which is its nearest competitor.

This dominance means movements on Binance can strongly affect how other traders and exchanges react.

The inflows may not only be a signal of fresh demand for Bitcoin and Ether, but it is also a sign of confidence in the crypto market despite the recent ups and downs. Traders tend to wait for opportunities after major liquidations, and Binance’s numbers indicate that they may be preparing for the next upward push.

Bitcoin’s Struggles Add Context

Some more context for these capital flows is Bitcoin’s volatile week. The flagship cryptocurrency dropped after a whale sold 24,000 BTC over the weekend and triggered strong liquidations. Tuesday saw Bitcoin fall under $109,000 before recovering above $111,000 according to TradingView.

More on this pressure, Bitcoin ETFs in the US recorded more than $1 billion in outflows last week, according to CoinShares. Still, there was a small positive note when ETFs saw net inflows on Monday and broke their six-day streak of withdrawals.

Overall, the numbers indicate that traders are ready to step back in when conditions improve.