Key Insights:

- Bitcoin recently blasted past the $120,000 price level, amid a general market surge.

- This surge has propelled Satoshi Nakamoto to the 11th place in the Forbes billionaires list.

- At Bitcoin’s current growth rate, Nakamoto will likely become the world’s richest individual before long.

Bitcoin continues to make new highs, and broke past the $120,000 price level over the weekend.

However, while this is happening, its anonymous creator, Satoshi Nakamoto has quietly entered the ranks of the world’s wealthiest individuals. According to recent updates, Nakamoto’s estimated holdings, which sit at roughly 1.096 million BTC, are now valued at over $132 billion.

As such, this places Nakamoto at number 11 on Forbes’ list of billionaires. Could a Bitcoin billionaire become the richest person in the world?

The Largest Known Bitcoin Holdings

According to insights from blockchain analytics firm Arkham, Nakamoto’s Bitcoin is spread across thousands of wallets. Moreover, many of these wallets have been untouched since he vanished from public view in 2011.

SATOSHI NAKAMOTO IS NOW THE 11TH RICHEST MAN IN THE WORLD

The value of Satoshi Nakamoto’s Bitcoin holdings increased by $7.4 Billion today, now worth $128.9B.

He has just overtaken Michael Dell, Chairman and CEO of Dell Technologies ($125.3B). pic.twitter.com/mzkcI2NIrr

— Arkham (@arkham) July 11, 2025

At current prices, these wallets collectively hold over $132.8 billion worth of BTC. This massive holding sits at far more than that of major corporate entities and other high-profile crypto investors.

For instance, corporations and custodians collectively control around 847,000 BTC, which is equivalent to just 4% of the total Bitcoin supply. The Winklevoss twins, which are known for founding the Gemini exchange hold around 70,000 BTC.

Venture capitalist Tim Draper owns approximately 30,000, while MicroStrategy co-founder Michael Saylor is believed to possess close to 18,000 BTC in personal holdings. Despite these impressive numbers, none come even close to Nakamoto’s stash.

Why Isn’t Satoshi on Forbes’ Billionaires List?

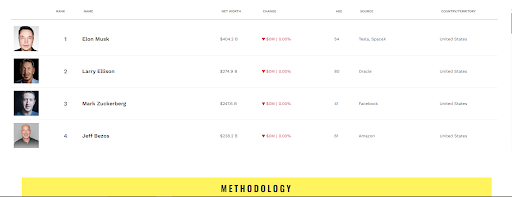

Despite the wealth that Nakamoto possesses, Forbes does not currently include Nakamoto in its list of top billionaires. This is because the publication only considers publicly verifiable assets like stocks, real estate and company ownership when calculating net worth.

In essence, crypto wallets, especially those controlled by anonymous individuals, fall outside their criteria.

That said, if Forbes were to consider crypto holdings, Nakamoto would already have overtaken Michael Dell, the CEO of Dell Technologies. For context, Dell’s net worth stands at $125.1 billion, placing Nakamoto just shy of breaking into the top 10.

How High Does Bitcoin Need to Go?

To become the richest person in the world, Nakamoto would need Bitcoin to rise further than it already has. Elon Musk, who is currently the world’s richest man, has a net worth of about $404 billion.

For Nakamoto’s Bitcoin holdings to match that, the asset would need to surge approximately 208% and hit around $370,000 per BTC. This is a steep climb, but not entirely out of reach according to some analysts.

For example, Bloomberg’s Eric Balchunas predicted that if Bitcoin maintains its historic average growth of 50% annually, Nakamoto could become the second-richest person by 2026.

If bitcoin does its normal 50%/ann then Satoshi will pass Buffett this year and Zuck sometime next year-ish to be #2 richest in world (Elon has huge lead). It's fascinating to ponder that the founder of something so successful never cashed in. It echoes Jack Bogle in that regard https://t.co/tu9MRzUD5h

— Eric Balchunas (@EricBalchunas) June 2, 2025

Other analysts from major asset management firms like Standard Chartered and Ark have also issued predictions between $200,000 and $250,000 before the end of 2025.

If even the most conservative of these predictions come true, Nakamoto’s ranking on the billionaires list is likely to balloon upwards very quickly.

One of the most fascinating aspects of Satoshi Nakamoto’s story is his refusal to profit from his invention. Despite holding a fortune worth over $130 billion, none of Nakamoto’s wallets have shown signs of activity for over a decade.

In all, whether or not Nakamoto ever claims the top spot on the billionaire list, his influence over the financial world is already cemented. And as Bitcoin edges toward $200K, $250K or perhaps even $370K, the name Satoshi Nakamoto will continue to endure.