Bitcoin falls to a two-week low while MicroStrategy signals new Bitcoin purchase with “Orange Dots.”

Bitcoin fell to $87,577 on Binance late Sunday, marking a two-week low amid renewed market volatility. Some analysts blame the selling pressure on the Bank of Japan policies on global risk appetite. Over the past month, Bitcoin has been trading around $85k-$95k, which shows a defined trading range. The recent dip below $88,000 has tested critical support and sentiment has been cautious.

Macro Pressures Maintain Downward Pressure on Bitcoin

The recent interest rate cut by the Federal Reserve did not have any significant impact on increasing cryptocurrency prices. Last Wednesday, the Fed cut the rate 25 basis points down to a target rate of 3.5% to 3.75%. Bitcoin dropped 1.08% in 24 hours, indicating continued sideways pressure. Investors are still cautious about risky assets, in the face of wider economic uncertainty and lower demand signals.

₿ack to More Orange Dots. pic.twitter.com/rBi1aagDVO

— Michael Saylor (@saylor) December 14, 2025

Macro trends have been more responsible for volatility than corporate buying over the last few weeks. Bank of Japan interventions and concerns about global economics added to downward pressure. Technical analysts focus on $85,000-$95,000 being important areas for market stability. Sustained weakness below $88,000 could add to bearish sentiment that could lead to further selling. Overall, macroeconomic conditions still affect the short-term behavior of markets.

Related Reading: Strategy challenges MSCI plan to drop digital asset companies | Live Bitcoin News

The Federal Reserve’s policy moves have not calmed the investment fears, despite reduced interest rates. Analysts say that cryptocurrency traders pay attention to long-term economic indexes and liquidity conditions. Central bank interventions around the world are still powerful, imposing pressure on speculative assets. Consequently, the market players keep track of the macroeconomic data and the technical support levels to trade effectively.

MicroStrategy’s Orange Dots Signal New Bitcoin Accumulation

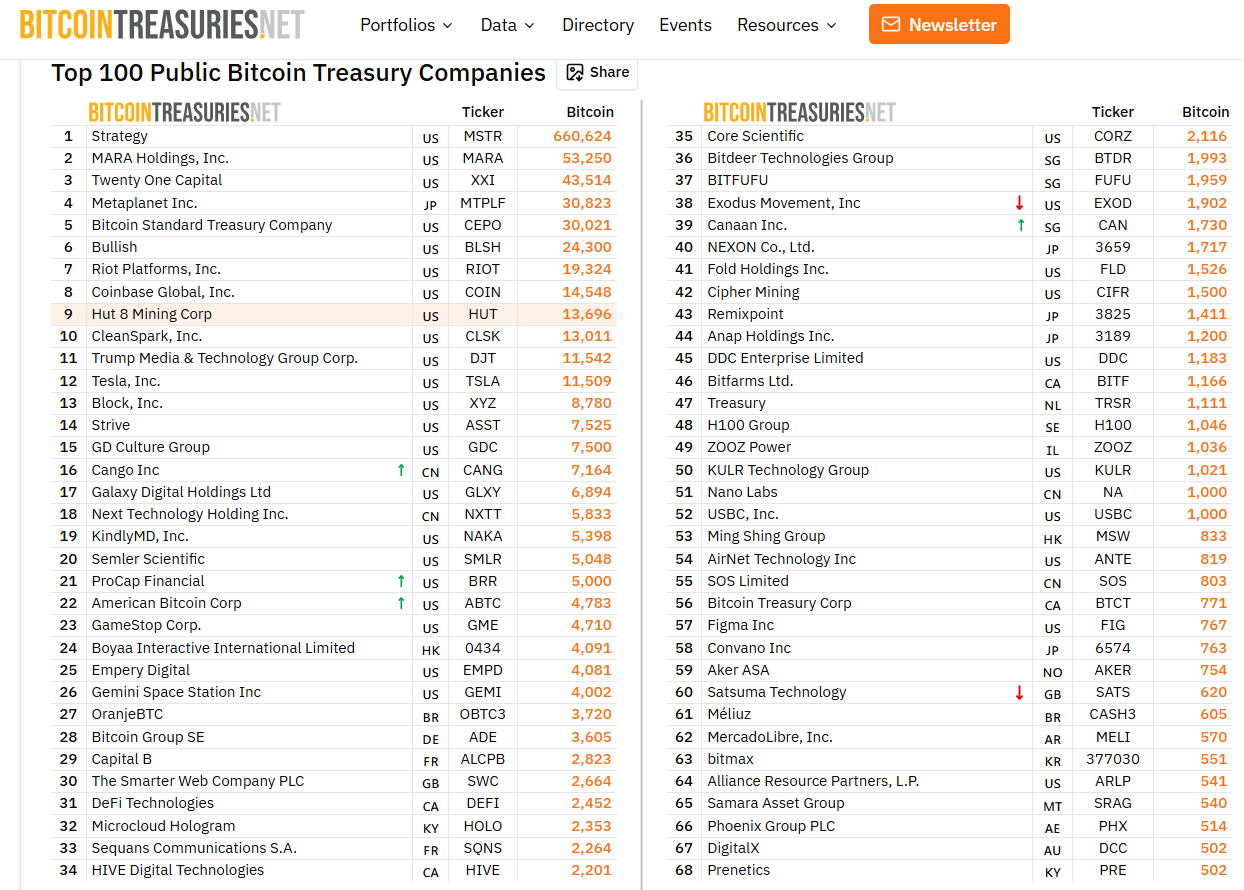

Michael Saylor, MicroStrategy founder, posted his signature “Orange Dots” chart, captioned: “₿ack to More Orange Dots.” This is being widely interpreted as a signal of an imminent, massive acquisition of Bitcoin. MicroStrategy currently holds around 660,624 BTC, making it the largest corporate Bitcoin holder worldwide. Saylor approaches price weakness as a long-term buying opportunity, and he continues with his accumulation strategy.

Historically, Orange Dot posts have preceded major acquisitions the next day, and it therefore influenced investor expectations. Corporate purchases may add temporary support during periods of selling pressure that is macro-based. Analysts underscore the fact that institutional accumulation is still a factor in shaping market liquidity and sentiment. Investors take all these corporate actions into account against the backdrop of global economic uncertainty and make trading decisions with a balance of optimism and caution.

Bitcoin’s range bound trading is both a reflection of the level of technical support as well as macro pressures. Market participants monitor $85,000 – $95,000 very closely as key areas of possible stabilization. Corporate accumulation offsets some downward trends in the macro economy, but volatility remains. The combination of institutional buying and economic conditions still characterizes short-term market sentiment.

Orange Dots may psychologically comfort traders and indicate possible buying opportunities through dips. Persistent macroeconomic pressures, central banks, and geopolitical risk factors are still critical risk factors. Investors pay attention to institutional cues, as well as technical ranges, when navigating through present market conditions. MicroStrategy’s continued accumulation strategy adds to its long-term confidence in Bitcoin’s value proposition.