Key Insights:

- Bitcoin is holding above $119,000 as cooling U.S. inflation supports risk assets.

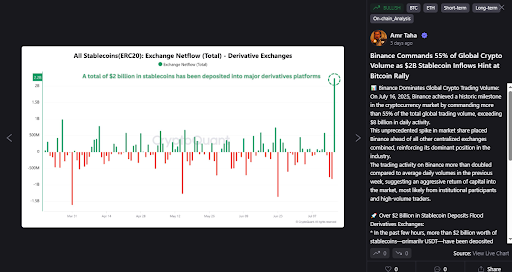

- Over $2 billion in stablecoin inflows within the derivatives markets shows a rising appetite for leveraged positions.

- Liquidity clusters near $120,000 indicate that Bitcoin may test new highs soon.

Bitcoin continues to show resilience, and is maintaining support above $119,000 amid cooling U.S. inflation data and a massive $2 billion stablecoin injection. Market sentiment is shifting and liquidity is building. Because of this analysts see a possible price breakout toward $120,000 and possibly higher.

Inflation Data Offers Relief to Bitcoin Bulls

Bitcoin received a boost from the latest U.S. Producer Price Index (PPI) data, which showed inflation cooling more than expected in June.

While the Consumer Price Index (CPI) had surprised markets with a slight uptick the day before, PPI numbers helped ease fears. The index rose 2.3% year-on-year, lower than the forecasted 2.5%, providing bulls with a welcome reprieve.

Traders were quick to respond. Crypto analyst Matthew Hyland pointed out that the CPI miss was largely driven by a temporary rise in oil prices, which have since come down. “There is no high inflation like nearly all the experts claimed would be here by now,” he wrote, suggesting that fears of a sustained inflation surge may be overblown.

The world is slipping back towards #deflation. Even the US reported zero #PPI.

Potentially good for risk assets #BTC etc as money printing returns BUT long term, just digging a DEEPER HOLE for the financial system which is unsustainable.

They love kicking the can down the road 🥹 pic.twitter.com/c0JD9EWajt— Matthew Dixon – Veteran Financial Trader (@mdtrade) July 18, 2025

Despite this, the market is not yet pricing in a Federal Reserve rate cut at the July 30 meeting. According to the CME Group’s FedWatch Tool, expectations for a rate reduction are still low. Still, the cooling inflation figures have historically supported risk assets like Bitcoin, which tend to perform better in a low-rate environment.

Bitcoin Finds Support as Liquidity Builds Near $120K

Bitcoin’s price action has been coiling between $116,000 and $120,000. The cryptocurrency is now forming a tight consolidation range that often comes before major moves. At the time of writing, BTC trades just above $118,000, and is up 2.4% over the past 24 hours.

Technical analysts are closely watching a liquidity zone between $119,500 and $120,500.

So far, these levels are thick with ask orders and are forming a magnet that could pull prices higher if momentum strengthens. According to the Coinglass liquidation heatmap, these clusters are areas of interest for both traders and automated trading systems.

Another aspect of the technical setup is the CME futures gap between $114,300 and $115,600. Historically, Bitcoin tends to revisit these “gaps,” but as trader Rekt Capital noted, BTC is currently holding above that level.

Looks like Bitcoin is finding support just above its Daily CME Gap$BTC #Crypto #Bitcoin https://t.co/QcNm4fopm7 pic.twitter.com/FWyxwX0lir

— Rekt Capital (@rektcapital) July 16, 2025

This indicates strength and could delay any pullbacks in the near term.

$2 Billion Stablecoin Injection And Institutional Appetite

Another major development adding fuel to Bitcoin’s price performance is the sudden influx of over $2 billion in stablecoins. This is especially Tether (USDT), into major derivatives exchanges.

This spike is typically seen as a precursor to massive long positions from investors, and shows that market confidence is at an all-time high.

According to CryptoQuant analyst Amr Taha the move is a clear sign that institutional players are setting up for a breakout. Tether’s minting of new USDT tokens also points to fresh demand from large investors.

Historically, such large-scale stablecoin deposits tend to come before price rallies. Traders use stablecoins to open futures contracts and perpetual positions, which increases market leverage and kickstarts price movement.

The timing of this liquidity inflow, combined with Bitcoin’s consolidation near a major resistance level sets the stage for a possibly explosive upside move.