Bitcoin has entered a rough patch as spot Bitcoin ETFs logged their longest streak of outflows in more than four months. According to data from Farside, CoinMarketCap, and SoSoValue, these ETFs saw more than $1.1 billion leave the market over the past five trading days.

The sell-off marked the highest level of withdrawals since early March and pushed Bitcoin into a deeper correction phase.

Bitcoin Oversold, Says Anthony Pompliano

At the time of writing, Bitcoin is trading near $113,200, after sliding almost 8% from its ATH of $124,747 on August 14. The pullback comes as institutional demand starts to soften and profit-taking is accelerating.

Now that Bitcoin is down nearly 5% in the past month, analysts believe that the market may be entering a consolidation phase.

Crypto investor Anthony Pompliano, in particular, believes the market is overlooking a massive opportunity.

ANTHONY POMPLIANO: “Bitcoin is definitely oversold at $113K.” 📉

Better times are coming. 🚀 pic.twitter.com/FQGsFYyeym

— Bitcoin Archive (@BTC_Archive) August 21, 2025

According to a recent conversation the LLC Capital founder had with CNBC, Bitcoin looks oversold at current levels near $112,000 to $113,000. Pompliano also pointed out that historical trends seem to be in favour of a stronger final quarter of the year, especially after April’s halving event.

“Right now, it is pretty oversold,” Pompliano explained. “September and October tend to be more active months after summer, and with the halving still fresh, the setup could favor buyers.”

Institutional Outflows Weigh on Bitcoin

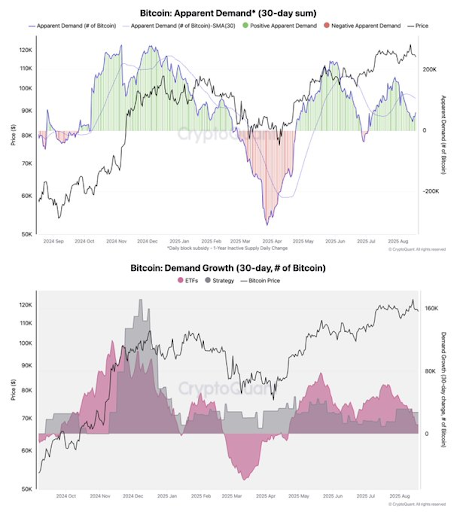

The heavy ETF withdrawals show that institutional appetite is weakening. SoSoValue data shows that net ETF purchases dropped to just 11,000 BTC over the past 30 days, which is their lowest since April.

Meanwhile, accumulation from major strategy firms has plunged from a peak of 171,000 BTC in November of last year to only 27,000 BTC in the past month.

On-chain metrics also show that demand is failing as well. According to a recent report from CryptoQuant analyst Julio Moreno, Bitcoin’s apparent demand has declined from a July peak of 174,000 BTC to only 59,000 BTC this week.

This means that with fewer large buyers stepping in, the market is now struggling to hold recent gains.

Fed Policy Adds Pressure on Bitcoin

More than crypto-specific factors, macroeconomic trends around the world are also weighing heavily on Bitcoin. Minutes from the July Federal Open Market Committee (FOMC) meeting struck a hawkish tone.

This, combined with a stronger-than-expected Producer Price Index report, increased the selling pressure on risk assets.

Traders are now looking to Federal Reserve Chair Jerome Powell’s upcoming speech at the Jackson Hole Symposium.

Powell set to speak today at 10 AM

WH says "major announcement" coming at noon

this could be Powell's last major speech pic.twitter.com/8otRZOcBEE

— VolSignals (@VolSignals) August 22, 2025

In essence, any hints about the path of interest rates could be what moves Bitcoin and other digital assets over the next few weeks. Current market expectations for a September rate cut have already cooled from 98% to 73%, according to CME’s FedWatch tool, and the next few days will be important for what comes next for Bitcoin.