Bitcoin dropped to less than $100 000, experiencing the most significant weekly decline in months amidst whale sales and ETF outflows, indicating low demand.

Bitcoin has fallen to less than $100,000 this week. Whales (large holders) rushing to sell added to the pressure of selling. This is the poorest weekly performance in months, with a 6.7 percent decline in a mere seven days.

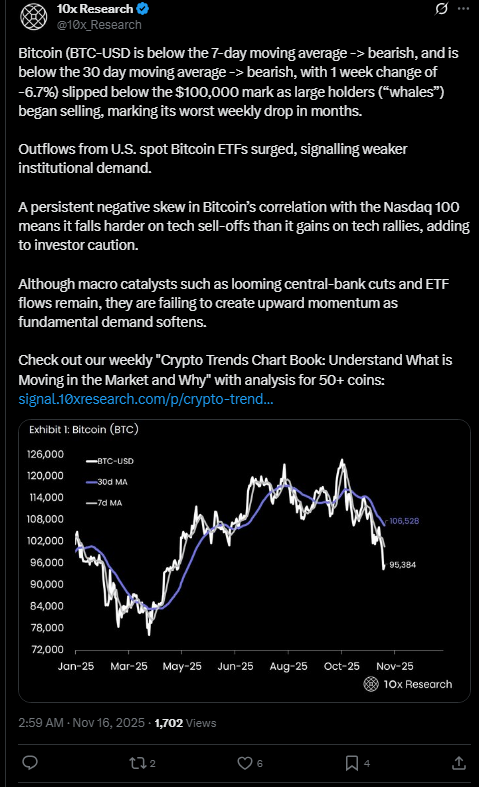

According to the 10x Research on X, Bitcoin is currently trading below its 7-day and 30-day moving averages. Both levels indicate a negative movement and worsening pessimism.

Source – X

Massive withdrawals were witnessed in U.S. spot Bitcoin ETFs, falling by more than a billion dollars in a day. Over three weeks, these funds showed declining institutional investor confidence as they lost $2.64 billion.

The vital market backing was removed by ETF holders and large wallets, and the price began to fall even more.

Waves of Outflow and Whale Moves Shake Market Stability

The stampede to the exit lasted throughout all major U.S.-listed Bitcoin ETFs. The second-largest daily outflow in the history of the ETFs occurred.

According to paraphrased comments on X, analysts pointed to a bearish regime in Bitcoin, citing whales selling and a declining ETF flow, which is contributing to falling prices as retail buyers retreat.

Whales were observed moving large sums to exchanges, with the goal of making a profit and contributing to the fall of Bitcoin. Risk aversion swept Wall Street and institutional buyers were wary.

The ETF outflows surged, but the correlation of Bitcoin with tech stocks also added additional volatility to the asset; the asset dropped more when tech stocks went on a tear, and experienced minimal gains when tech stocks were on a tear.

There was no evident event to change the direction. Although there were speculations on central-bank rate cuts and macroeconomic forces, in essence, the primary demand for Bitcoin remained to decline in core, and the future of the price remained uncertain.