Bitcoin may reach $140,000 this October, according to data-driven simulations. Could October deliver outsized gains?

Bitcoin’s strong start to October has fueled talk that the world’s largest cryptocurrency could reach $140,000 before the month ends.

Economist Timothy Peterson believes that there is a 50% probability for this outcome, based on hundreds of simulations. According to the analyst, these simulations are based on real market data rather than sentiment or opinion.

Bitcoin Forecast Backed by Historical Data

Peterson’s analysis relies on daily price data going back to 2015. The model simulates how Bitcoin has moved during past market cycles and uses that pattern to predict what comes next.

Half of Bitcoin's October gains may have already happened, according to this AI simulation.

There is a 50% chance Bitcoin finishes the month above $140k

But there is a 43% chance Bitcoin finishes below $136k. pic.twitter.com/LPhFr0mry9— Timothy Peterson (@nsquaredvalue) October 7, 2025

He stressed that the prediction is based entirely on historical volatility and price patterns. “This is not human emotion or biased opinion,” Peterson said. “It’s a probability-based forecast that reflects how Bitcoin has tended to behave.”

The economist noted that about half of Bitcoin’s usual October gains may already have occurred. However, historical data still supports the case for further upside.

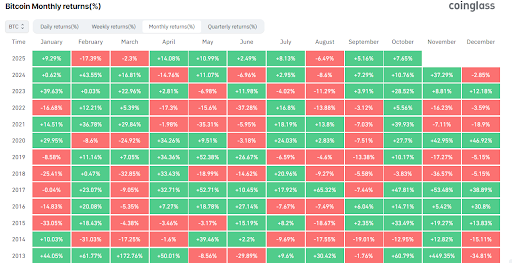

October Has a Record of Strong Bitcoin Gains

According to CoinGlass, October has been Bitcoin’s second-strongest month on average since 2013. The month has delivered typical gains of around 20.7% for years. November has historically been even stronger, with an average rise of more than 46%.

This seasonal pattern shows changes in liquidity and institutional capital. Peterson explained that October stands as the end of third-quarter portfolio rebalancing, the start of new fiscal year planning for many funds, and the lead-up to year-end reporting.

Institutional Buying and Shrinking Supply

Meanwhile, strong institutional participation continues to affect Bitcoin’s rally. US-listed spot Bitcoin ETFs have added more than $60 billion in inflows since approvals in January of last year, including $3.2 billion in just the past week.

Exchange reserves of Bitcoin have also dropped to a six-year low of 2.83 million BTC. Roughly 170,000 coins were withdrawn from trading venues last month, and are showing accumulation by long-term holders.

This tightening supply tends to act as a cushion against price declines and helps to keep pullbacks shallow even as BTC consolidates after rallies.

Derivatives Market Shows Healthier Signals

Data from CryptoQuant analyst Darkfost shows that selling pressure in the derivatives market is easing. The Net Taker Volume indicator, which compares aggressive buy and sell orders, has moved from deeply negative to neutral territory.

Darkfost noted that a similar trend change occurred before the April market rebound. This indicates that the current derivatives environment may again support Bitcoin’s price.

On-chain data also shows that there has been strong participation by new buyers. CryptoQuant’s Axel Adler Jr reported that short-term holder supply grew by more than 550,000 BTC in the last quarter.

This reached 4.94 million BTC, and analysts say this influx tends to mark the early phase of a strong uptrend.

Technical Levels and Market Sentiment

Analysts are watching several price zones at this point. Glassnode data shows soft support around $121,000 to $120,000, with a stronger base near $117,000, where about 190,000 BTC last changed hands.

A retest of that area could invite fresh buying interest.

Above current levels, many traders see $125,000 as an important line of resistance. This means that breaking through and sustaining above that mark could pave the way for a run toward $140,000.

#Bitcoin retesting the previous all-time highs.

It's definitely over.

For bears.

Send it higher. pic.twitter.com/eeztjIIZ1m

— Jelle (@CryptoJelleNL) October 7, 2025

Crypto analyst Jelle said on X that Bitcoin is retesting previous highs and could break higher.