The Bitcoin bull market is over, according to a technical analyst, is based on trend breakdown on a 200-day basis. The community in crypto is split on a bearish forecast for 2026.

There is increasing technical pressure on Bitcoin. One of the leading pundits argues that the bull market has reached its end.

Crypto Birb uploaded a viral review of X. The message alerted followers against coming bearish signals. Bitcoin exhibits consistent shifts in trend validated by a number of metrics, according to Crypto Birb on X.

Source – Crypto Birb X.

The post garnered more than 43,200 views. There was fierce controversy in crypto circles. The percentage of price movement is an indicator of impending trouble.

The pattern of distribution is indicated by spikes in the volume. High volatility is an indication that the market remains unstable. The bearish momentum is supported by time below the 200-day trend.

Bulls Fire Back With Counter-Evidence

The bearish narrative is not accepted by all. On X, Timbo78625468 appealed the analysis. Higher highs and lows are still seen according to Timbo78625468 on X since the bear bottom.

Source – X, Timbo78625468

The technical structure is resilient. Bitcoin may continue falling and still remain in the bull market. There are no support lines randomly that define cycle ends.

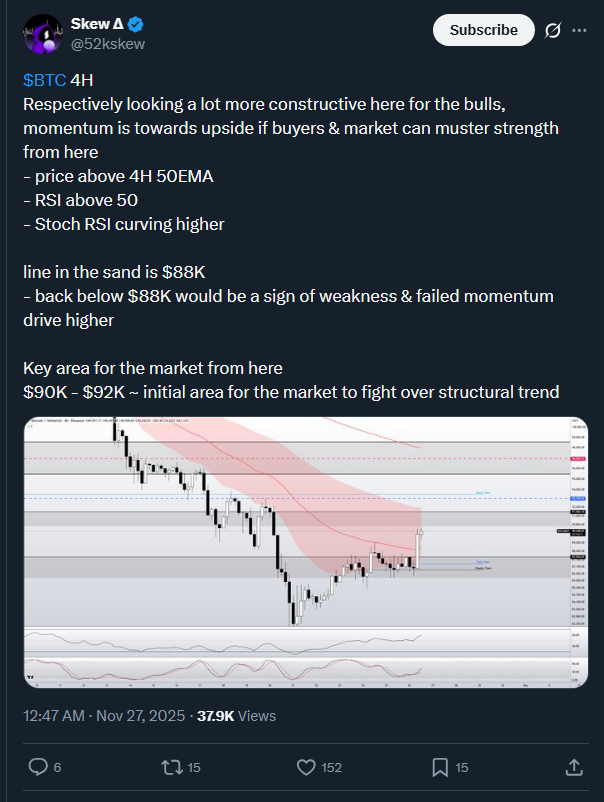

52kskew offered optimistic technical analysis. The analyst observed positive 4-hour chart patterns. The positive price movement is above the 4-hour 50 EMA.

You might also like: Bitcoin News: Bitcoin ETF Exodus: $3.5B Flee – Crash Incoming?

Critical Price Levels Define Next Move

RSI exceeding 50 reinforces the momentum argument. The stochastic RSI drifts towards the bullish region. $88,000 is the line in the sand, according to 52kskew on X.

Source – 52kskew on X.

Anything less than a break below 88,000 is an indication of weakness. The bearish thesis would be proved by failed momentum drives. This is the important support area that bulls have to protect.

The $90,000 to $92,000 range matters most. The first structural trend battles are held here. Participants of the market struggle over crucial resistance points.

Patterns of distribution indicate that there is pressure to sell. The breadth indicators deteriorate throughout the market. There are various periods that verify the concerted actions among signals.

Bitcoin has retested significant support over the past few weeks. With every bang, the force diminishes. Volume profiles indicate accumulation areas that move downward.

The 200-day moving average is a psychological barrier. Price finds it hard to regain this vital level. Past records indicate that corrections were preceded by similar patterns.

Momentum indicators give flash signals of the past. MACD divergences are seen in daily charts. Relative strength is still falling against major assets.

There is a decline in market structure, even though it rebounds now and then. Reduced highs are established in smaller time periods. Support areas cannot retain purchasing interest.

The analysis by Crypto Birb reveals a weakness in 2026. The prognosis indicates further downward force. Several signs support this negative forecast.

In crypto, technical breakdowns are seldom reversed overnight. The trends need time to develop. Patient traders are waiting to be given more directional signals.

The community is still heavily divided. Strong fundamentals in support of prices are cited by bulls. Instead, Bears cite worsening technical conditions.

You might also like: Bitcoin News: Legendary Trader Sounds Alarm on Bitcoin Collapse