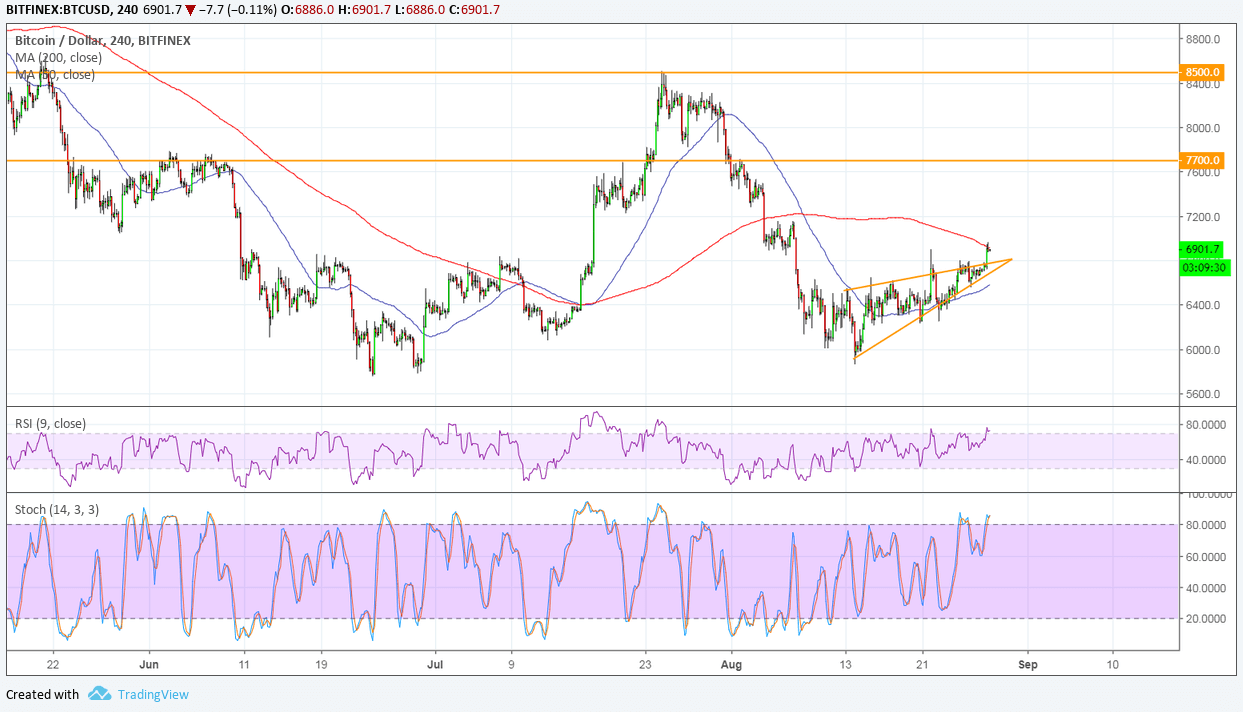

Bitcoin appears to have broken above its short-term rising wedge consolidation to signal that further gains are in the cards. The wedge formation is around $1,000 in height so the resulting climb could be of the same size.

This should be enough to take Bitcoin up to the next area of interest around $7,700 to $7,800. Stronger bullish pressure could lift it up to the $8,500 mark, which would then complete a longer-term double bottom reversal formation.

However, the 100 SMA is still below the longer-term 200 SMA to suggest that the path of least resistance is to the downside. In other words, the selloff is still more likely to resume than to reverse. Bitcoin is already testing the dynamic resistance at the 200 SMA and a break higher could pave the way for more gains.

RSI is on the move up so Bitcoin could follow suit while buyers remain in control, but the oscillator is closing in on overbought levels to reflect exhaustion. Similarly stochastic is pointing up but dipping into overbought territory, and turning lower could bring in selling pressure.

Bitcoin is drawing support from news that CFTC figures revealed a decline in bearish bets on bitcoin futures. This could support the highly-anticipated rebound until the end of the year, possibly getting an additional boost from Bitcoin ETF approvals.

Recall that the SEC earlier denied a few applications but quickly followed up with a decision to review this rejection. This kept traders hopeful for approval in the next set of applications due for rulings in late September.

If so, it could pave the way for a huge leg higher in Bitcoin price as this could bring in more volumes and activity. It also helps that risk-taking has been observed in the financial markets so far this week thanks to the US-Mexico bilateral trade deal.

Images courtesy of TradingView.