ETF redemptions and sustained U.S. selling signal deeper pressure on Bitcoin beyond leverage-driven liquidations.

Bitcoin’s sharp decline over the past week erased all gains made since Donald Trump’s election victory. And this has marked a turning point in market sentiment. Heavy liquidations and weak institutional demand have pushed prices sharply lower. At the same time, shifting macro signals have added to the market pressure.

Analysis from Wintermute suggests recent moves reflect deeper structural pressure rather than a short-term shock. Attention has now turned to whether spot demand can return after a violent reset in leverage.

BTC Selloff Deepens After $2.7B in Liquidations as Institutional Demand Weakens

Bitcoin breached $80,000 for the first time since April last year. In fact, the OG coin dropped almost 50% from October’s all-time high near $126,000. Weekend trading saw prices briefly touch $60,000 before rebounding into the low $70,000 range.

Liquidations exceeded $2.7 billion as months of range-bound trading encouraged excessive leverage. Once prices broke key levels, forced selling accelerated across major venues.

Macro conditions also worsened the already fragile market. Kevin Warsh’s nomination as U.S. Federal Reserve Chair on January 30 triggered fears of tighter financial conditions. As a result, major tech firms and even precious metals dropped in price.

Rallies failed to gain traction as investors exited their positions. Generally, this pattern is common during bearish phases. Exchange-traded funds have become central to price action during such moves. iShares Bitcoin Trust (IBIT) traded more than $10 billion in notional value on Thursday alone, reflecting how tightly ETF flows now influence short-term direction.

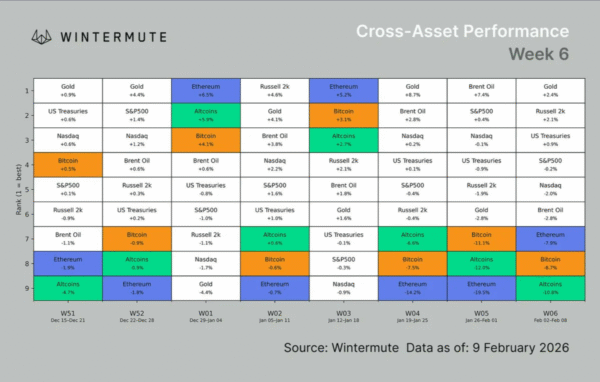

Image Source: X/Wintermute

Selling pressure came largely from U.S. sources. Coinbase’s spot premium remained negative throughout the decline, signaling sustained domestic selling interest. Internal over-the-counter data cited by Wintermute shows U.S. counterparties reduced exposure all week.

ETF redemptions amplified that pressure, creating a loop where falling prices forced further spot sales. Since November, spot BTC ETFs have recorded roughly $6.2 billion in cumulative net outflows, marking the longest drawdown since launch.

AI Capital Rotation Leaves Bitcoin Exposed During Market Pullback

Options activity has become concentrated, with IBIT and Deribit now accounting for about half of total crypto options volume. Compressed volatility during prior range trading encouraged complacency.

Once prices broke lower, traders rushed to exit crowded positions. And this drove funding rates sharply negative before a brief short squeeze late in the week.

Capital rotation toward artificial intelligence stocks added another headwind. For months, investor attention and liquidity flowed into AI-linked equities at the expense of other assets.

Charts circulating last week showed Bitcoin closely tracking software names in major indices. When AI-related trades weakened, crypto failed to attract displaced capital. As a result, prices were left exposed during broader selloffs.

Wintermute views last week’s action as a form of capitulation, with leverage largely flushed out. Volatility jumped as weaker positions were flushed out, with buyers stepping in around $60,000.

Spot trading remains light, which limits recovery potential. About $25 billion in unrealized losses across institutional treasuries is also weighing on new demand. Without a trend flip, price action is likely to stay choppy.