Key Insights:

- Bitcoin whales sent over 61,000 BTC to exchanges in a single day, which is the largest inflow in a year.

- Bitcoin dominance dropped from 64% to 60% in four days, and capital is shifting to altcoins.

- Ethereum, Solana, and XRP have posted strong gains, with the meme coin market cap nearing $90 billion.

On July 17, Bitcoin whales transferred over 61,000 BTC to exchanges, according to on-chain data from CryptoQuant. This was the biggest single-day Bitcoin inflow to exchanges in a year.

The timing of this move is especially interesting, considering how it happened just days after Bitcoin hit a new all-time high of $123,000. But while this may seem like bearish news for Bitcoin, the general crypto market tells a different story.

Bitcoin Dominance Falls

Something more interesting than the sell-off is going on. This event is in Bitcoin’s market dominance.

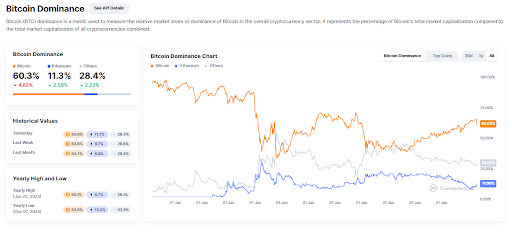

Data shows that between July 17 to July 21, Bitcoin dominance (BTC.D) dropped sharply from 64% to 60%. This may seem like a small percentage change. However, in the context of crypto market dynamics, it’s a big deal.

A declining BTC dominance usually shows that investors are rotating funds from Bitcoin into altcoins. When this happens while Bitcoin is consolidating after a rally, it often marks the beginning of an altcoin season.

In past cycles, similar drops in BTC.D always came before massive rallies in Ethereum, Solana, and other mid-cap tokens.

As it stands, the pattern appears to be repeating.

Ethereum, Solana, and Meme Coins Rally as Bitcoin Cools Off

While Bitcoin is taking a breather, altcoins are gaining steam. Ethereum, XRP, and Solana have all posted double-digit gains in the past week.

Even meme coins, which are often seen as the speculative edge of the market, are catching fire. The total market cap for meme coins so far has surged 8% in a single day and is now approaching $90 billion.

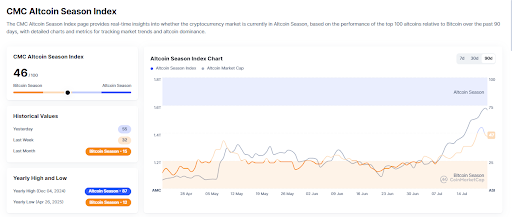

The Altcoin Season Index, which tracks whether altcoins are outperforming Bitcoin, has also jumped from 32 to 56 over the past few days. An index value above 75 is generally considered a full-blown altcoin season. However, this rise indicates that we’re quickly heading in that direction.

This shift isn’t just about performance. It is also psychological. As Bitcoin stabilizes and fails to generate new highs, investors will start to hunt for higher returns elsewhere.

As it turns out, the altcoins always provide that opportunity.

BTC Cooling Off Fuels Altcoin Surge

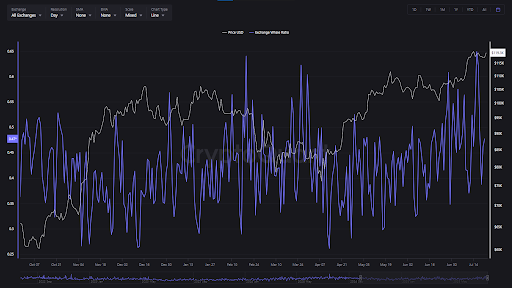

The whale activity behind the scenes offers some interesting clues. According to CryptoQuant analyst JA Maartun, the 61,000 BTC inflow can be broken down into three major chunks.

Time to stay cautious 😉

Open Interest in altcoins is starting to diverge from Bitcoin Open Interest. It’s all good while the music’s still playing—but there’s a risk hanging overhead. pic.twitter.com/ONS9J1MsBg

— Maartunn (@JA_Maartun) July 21, 2025

The whales transferred 32,300 BTC in just one hour, after two earlier batches of 15,800 BTC and 13,400 BTC. All of these transfers came from wallets holding over 100 BTC, which is classic whale behavior.

The large movements show a coordinated profit-taking move after Bitcoin’s rally to $123,000. But interestingly, the market hasn’t collapsed. Bitcoin has held support above $115,000, which is a sign that new buyers are absorbing much of the sell pressure.

At the same time, whales seem to be rotating into altcoins themselves. Or at least, they’re creating the conditions for altcoins to thrive by reducing the downside pull of Bitcoin.

Overall, Bitcoin’s current consolidation phase doesn’t necessarily mean that it is weak. After a massive rally, markets often need time to cool off and digest gains. As it stands, the support at $115,000 has held strong so far.

If whales continue selling, that support may be tested again. But if institutional buyers and retail traders continue to step in, Bitcoin could stay in this consolidation phase without a deeper correction.