According to Glassnode in a recent update, Bitcoin’s recent price action is still following patterns seen in past halving cycles.

This is a direct challenge to the belief that the rate of institutional adoption has permanently changed Bitcoin’s structure.

Glassnode explained in its latest report that Bitcoin’s price behaviour “is still similar to past patterns” and may be further along in its cycle than most expect.

Signs That Bitcoin Is Cooling Off

Glassnode pointed to several signals that Bitcoin’s cycle is still alive and well. Long-term holders, or those who have held Bitcoin for more than 155 days, are taking profits at levels similar to previous euphoric phases.

This selling activity usually happens late in a cycle when confidence is high.

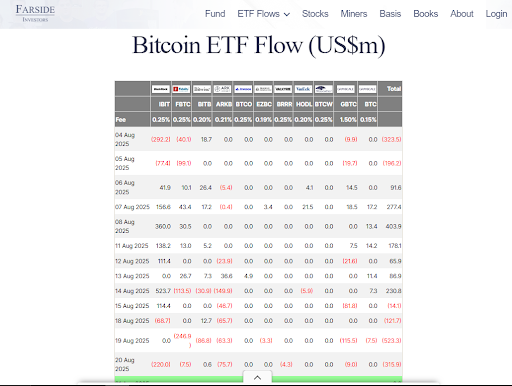

At the same time, demand is weakening. Spot Bitcoin ETFs recorded outflows of nearly $975 million over just four trading days, according to Farside Investors. This drop in inflows shows fatigue in capital coming into Bitcoin.

Bitcoin’s price reached a new all-time high of $124,128 on August 14 but has since fallen by 8.3 per cent to $113,940. Over the past 30 days, the cryptocurrency has been down about 2.8%, which further shows the cooling momentum.

Traders Shift Toward Volatility Bets

The slower demand for Bitcoin has also changed trading behaviour. Glassnode noted a surge in speculative positioning, especially with open interest across major altcoins, briefly hitting a record $60 billion before correcting by $2.5 billion.

This trend shows a move away from Bitcoin toward riskier assets.

The question now is, will Bitcoin hit a peak in October?

If Bitcoin continues to follow this historical cycle, the market could be close to peaking. Glassnode noted that the market’s highs might arrive as early as October.

The on-chain data resource backed this up with data. For example, in both the 2018 and 2022 cycles, peak cycle highs happened just two or three months later than the current timeframe when measured from cycle lows.

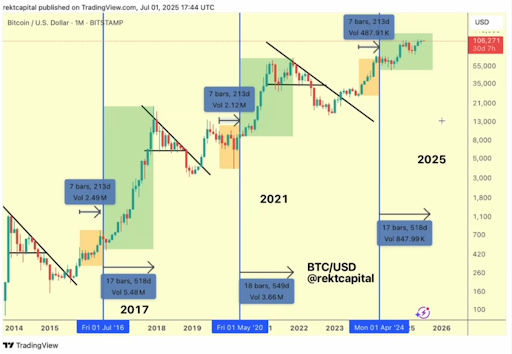

According to crypto analyst Rekt Capital in a July prediction from YouTube, if Bitcoin repeats the 2020 cycle, the market could peak in October, or around 550 days after the April halving event.

Other analysts have noted that Bitcoin typically takes about 1,060 days to move from a cycle bottom to a peak. This said, Bitcoin is currently around 1,000 days from its 2022 bottom and may still have room to climb.

For about a month or two.

Institutional Adoption Challenges the Cycle

Not everyone agrees with the theory, though. Some industry leaders are arguing that institutional adoption has already broken the four-year pattern.

Investor Jason Williams, for example, pointed out that the top 100 treasury companies collectively hold close to 1 million Bitcoin. Data from BitcoinTreasuries.NET shows that publicly traded treasury companies currently hold around $112.17 billion worth of Bitcoin.

This concentration of institutional holdings is a factor that was not present in past cycles.

🚨DID I HEAR SUPER CYCLE???

The four-year cycle is dead and adoption killed it.@Matt_Hougan says we're going higher in 2026.

Early profit takers will be left behind!!!

Full break down with @JSeyff and @Matt_Hougan in comments👇 pic.twitter.com/Ffn9penapN

— Kyle Chassé / DD🐸 (@kyle_chasse) July 25, 2025

Matt Hougan, chief investment officer at Bitwise, went further to say in July that the Bitcoin cycle “is dead.” He expects Bitcoin to see more positive performance in 2026, and claimed that halving cycles matter less with time