- BitMine crosses $2B Ether mark, aims for five percent total supply.

- SharpLink and Foundation trail BitMine’s huge corporate Ethereum treasury push forward.

- BitMine’s asset-light strategy combines staking, reinvestment, market volatility for gains.

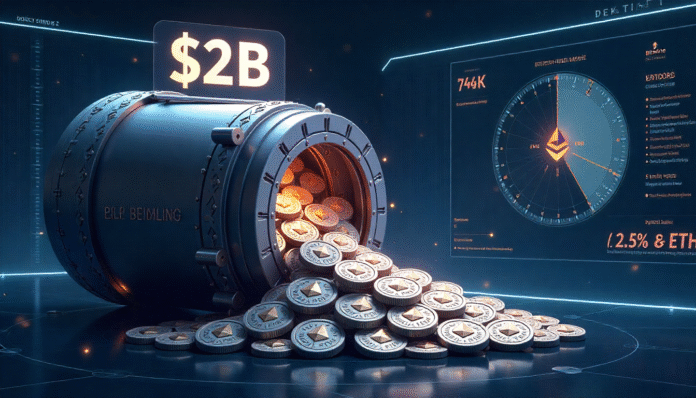

BitMine Immersion Technologies is making big moves in the crypto world. The company has announced that it now holds more than $2 billion worth of Ether (ETH). This is a milestone less than two weeks after raising a first-time private placement of 250 million on July 8th.

BitMine Tops Ether Treasuries, Surpasses SharpLink Gaming and Foundation

Bloomberg reported that BitMine currently has 566,776 ETH, each worth approximately 3,643.75 dollars. This huge stake is a good indication of the faith in Ethereum. Tom Lee, the managing partner of FundStrat and chairman of BitMine revealed the long-term vision of the company. BitMine, according to him, is already well on course towards achieving its objective of owning 5 percent of the total supply of Ethereum and staking it.

The buying spree of BitMine demonstrates the rapidity with which institutional interest in Ethereum is increasing. The other significant holders are SharpLink Gaming with approximately 360,800 ETH and Ethereum Foundation with approximately 237,500 ETH. This makes BitMine the biggest Ether treasury in the world privately.

Jonathan Bates, the CEO of BitMine, also talked of this milestone. The company is still confident in the development of Ethereum and its approach is not simply a short-term purchase move, he said. The strategy of BitMine incorporates staking, capital market operations, and mining revenues. This strategy will develop a robust, scalable crypto financial system that is able to adjust to market fluctuations.

The management of BitMine feels that Ethereum has the massive potential that can be exploited in treasury innovation. The company employs what they term as an asset-light method. This implies that the company does not spend large amounts of money on physical infrastructure. Rather, it specializes in the storage of digital assets and the acquisition of returns in the form of staking. This model enables BitMine to do risk management and raise its exposure to digital assets.

Staking, Reinvestment Drive BitMine’s Plan to Grow ETH Per Share

The strategy also includes using market volatility to lower capital costs. This will enable the company to purchase additional ETH once its value reduces. The performance target of the company is to increase the number of ETH value per share. This plan is in line with its strategy to reinvest in profits, capitalize markets intelligently, and receive staking rewards.

The ambitious action of BitMine is indicative of a larger trend. An increasing number of companies view crypto, particularly Ethereum, as a significant component of their balance sheets. The crypto market is also gaining trust of large investors as new regulations are being formed. Lots of companies hope that crypto treasuries will be a standard approach to companies that desire hedging against inflation and obtaining passive income.

The future moves of BitMine may determine the way crypto treasuries will be managed by other businesses. It has a massive amount of ETH as a corporate crypto reserve, which is a new standard. This would make other firms adopt the same direction.

BitMine sends a message by targeting 5% of the entire supply of Ethereum. The company feels that Ethereum will be a significant contributor in the blockchain world in the years to come.

Market observers and investors will be following BitMine very closely to see what they do next. The rapid development of the company demonstrates that crypto treasuries are no longer just a side project; instead, they are central to new financial strategies.