BlackRock’s Bitcoin ETF just saw its largest outflow in two months as prices dipped. Despite this, institutional interest in crypto is strong.

BlackRock’s iShares Bitcoin Trust (IBIT), one of the most closely watched Bitcoin ETFs, just recorded its biggest outflow in two months.

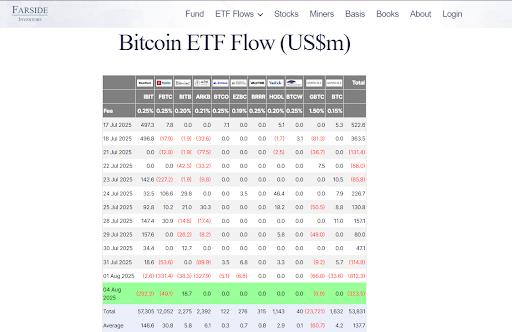

The $IBIT experienced $292.5 million in withdrawals on Monday, just as Bitcoin prices fell over the weekend, only to stage a minor recovery by the start of the week.

The outflow stands as a break in what had been a strong streak for BlackRock’s fund and other spot Bitcoin ETFs. It also shows that the market traction might be slowing down after a particularly bullish July.

Bitcoin ETFs Outflows Follow Price Dip

The sudden outflow from BlackRock’s BTC fund came after a massive decline in the price of Bitcoin. Over the weekend, Bitcoin slid 8.5% and fell from its July 14 all-time high to a low of $112,300, before bouncing back to $115,000 on Monday.

This price movement appeared to shake investor confidence temporarily. BlackRock’s IBIT saw a $292.5 million outflow, which was the largest since May, amid a smaller outflow on Friday that ended a 37-day streak of inflows.

It wasn’t just BlackRock feeling the heat. Fidelity’s Wise Origin Bitcoin Fund (FBTC) reported a $40 million outflow, and the Grayscale Bitcoin Trust (GBTC) shed $10 million. Interestingly, only Bitwise’s Bitcoin ETF (BITB) saw inflows, pulling in $18.7 million.

July Was Still a Massive Month for BlackRock

Even with the recent dip, July was a big win for BlackRock. The iShares Bitcoin Trust recorded $5.2 billion in net inflows during the month, which accounted for 9% of its total inflows since launching last year.

The fund has now raked in more than 700,000 BTC, which shows how much institutional capital has poured into the asset. This large holding indicates that, despite short-term fluctuations, confidence in the long-term value of Bitcoin is still solid among big investors.

Digital Assets Are Outpacing Trad-fi Alternatives

The recent ETF outflows don’t show a wider downturn in digital asset interest. In fact, digital assets are currently the fastest-growing segment in the alternatives market.

According to data shared by Bloomberg’s ETF analyst Eric Balchunas, digital assets and hedge funds are pulling ahead. On the other hand, fundraising in private equity and private credit slows down.

JPMorgan’s Nikolaos Panigirtzoglou also confirmed this trend. He noted that investors are increasingly turning to digital assets for exposure to alternative markets. By late July, the segment had already attracted $60 billion in capital and was on track to rival last year’s record of $85 billion.

JUST IN: 🇺🇸 Donald Trump says "we're embracing the future with crypto and leaving the slow and outdated big banks behind."

— Bitcoin Magazine (@BitcoinMagazine) September 12, 2024

Spot Bitcoin ETFs Are Reducing Market Volatility

One of the most promising signs for institutional investors is the reduced volatility of Bitcoin since the launch of spot ETFs.

The 90-day rolling volatility for BlackRock’s IBIT has now dropped below 40 for the first time. For context, when these ETFs first launched, volatility was above 60.

This means that Bitcoin is experiencing fewer wild price swings and a more stable investment environment. As Balchunas noted, the market has moved away from “vomit-inducing drawdowns.” This is making BTC far more attractive to larger investors and institutions.

This reduced volatility could be the key to Bitcoin’s adoption over the next few years.

As the asset becomes more stable, the case for using it as a functional currency rather than just a speculative one grows stronger.