Binance Coin targets $2000 as Bitcoin fuels momentum, with traders watching BNB’s setup, near-term risks, and CZ speculation.

Binance Coin has been rising alongside Bitcoin lately, and is setting new all-time highs while drawing attention from traders and investors.

On September 21, BNB touched $1,083 before easing back to the $1,050 range. This marked another milestone in its rally, which started after it broke major resistance levels earlier in the year.

Market analysts now expect BNB to aim for $1,187, and if Bitcoin continues to hold steady above $115,000, BNB could climb toward $1,500 and possibly $2,000 over the coming months.

Binance Coin Eyes $2000 After Breaking Records

The $740 resistance level, which capped BNB for months, finally broke in July.

After the breakout, the token retraced to retest that zone and then bounced higher in August. That move confirmed strong buyer support and marked the start of a new upward phase.

Since then, BNB has climbed relentlessly and is making fresh highs. Its latest peak at $1,083 shows that investors are confident in Binance’s ecosystem. Despite profit-taking by some traders, the overall market trend remains positive, according to TradingView.

On longer timeframes, BNB’s behaviour is similar to that of past cycles. For example, during the 2020–2021 rally, it spent nearly 18 months under $40 before exploding to $691.

While its market cap is now much larger, analysts are warning against calling the top too early.

Traders Brace for Possible Pullback

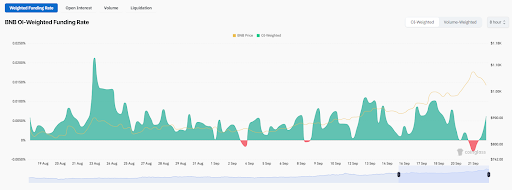

While the long-term outlook appears strong, short-term traders are preparing for corrections. The price action even shows this, and data from CoinGlass indicates that funding rates for BNB futures dropped to a two-month low.

This means that more traders are betting against the rally.

If bearish sentiment continues to gain strength, BNB could be on the verge of retracing toward the $1,000 psychological level. This means that such a move could trigger $61 million worth of liquidations in long positions.

A deeper drop could test demand around $950–$1,000 and, in a worst-case scenario, $800.

This being said, holding above $1,083 would invalidate bearish expectations and open the path to $1,100 and higher.

Changpeng Zhao Speculation Adds Fuel

Beyond technicals, Binance Coin has also been buoyed by speculation about its founder, Changpeng Zhao (CZ).

The former Binance CEO stepped down in 2023 after a $4.3 billion settlement with U.S. authorities and served a short prison sentence.

Now, rumours are swirling about a possible pardon from President Donald Trump. Betting markets once priced CZ’s chances above 60%, even though they have since slipped closer to even.

Even so, the speculation has lifted sentiment for BNB.

A cryptocurrency with ties to Binance Holdings Ltd. struck an all-time high as speculation builds that the digital-asset exchange’s co-founder Changpeng Zhao will be granted a US presidential pardon https://t.co/wi3RqO0i1z

— Bloomberg (@business) September 22, 2025

Zhao’s recent changes to his X profile created further talk of a comeback. Traders are seeing a pardon as a possible turning point for Binance, which continues to live under regulatory monitoring.

The Road to $2,000

Binance Coin continues to prove its strength lately, as both a utility token and a speculative asset. Its technical strength, Bitcoin’s support and market narratives have all converged to push BNB higher.

If Bitcoin maintains its current trend and demand for BNB continues to push through, a climb to $1,500 and possibly $2,000 could very well be within reach.

Short-term volatility continues to be a cause for worry, but the overall structure indicates that there could be more upside ahead.