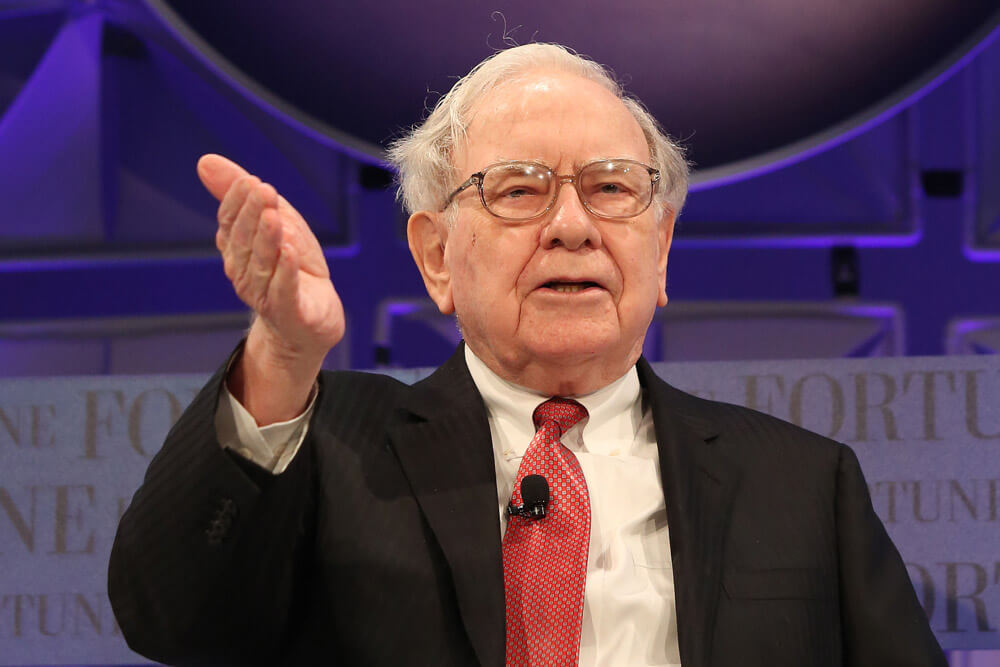

As we all know by now, Berkshire Hathaway is run by one of the biggest bitcoin haters across the globe. Warren Buffett – a billionaire and entrepreneur – has made it clear in the past that he wants nothing to do with cryptocurrencies and has even called bitcoin a “fraud” and compared it to a button on his coat in a recent CNBC interview.

Warren Buffett Is Always Going to Hate BTC

This month, Warren Buffett indulged in a nearly $5 million lunch with founder and CEO of TRON Justin Sun. The lunch had been talked about for months, and despite several health problems allegedly being suffered by Sun, the plan was always to meet in person and potentially talk crypto. This occurred in early February, and Sun – among other things – gifted Buffett a new phone with a full bitcoin loaded onto it.

While Buffett happily accepted the token, it is clear the gift hasn’t made him any more of a bitcoin lover in recent days. In his latest interview, he is again badmouthing the world’s number one cryptocurrency by market cap, claiming that it only attracted criminals to the fray and that cryptocurrencies had “no value.”

He explained:

You can’t do anything with [bitcoin] except sell it to somebody else, but then that person has got the problem.

So, despite all the hard work on Sun’s part, it’s clear Buffett hasn’t changed his mind. At this stage, one can assume that he’ll be a bitcoin hater for the rest of his life, which unfortunately, has already begun to take a huge financial toll on his personal and professional investments.

According to a new report, Buffett recently bought more than $4 billion worth of stock in the banking company JPMorgan. Each share was purchased at approximately $112, while at the time of writing, those same stocks are up by about $20 each. Thus, every share purchased by Buffett has gone up to roughly $132. His total earnings exceeded $600 million at press time.

A Lot of Money Lost

This sounds good. Heck, it sounds great, but then the report shows what would have happened if Buffett was able to get past his hatred and ego and accept bitcoin as a valid means of investment. If the same amount of money used to purchase the JPMorgan stock had been used to purchase bitcoin units at around $6,600 each (it was trading for this price during May of last year), by now, the earnings for Buffett and his company would have been nearly $2 billion.

Overall, it’s estimated that Buffett has missed out on at least $1 billion in profit. That’s a lot of money to potentially throw down the drain. Perhaps the time has come for Buffett to finally see the light and understand that bitcoin is worth a lot more than one’s coat buttons…