The SEC missed the deadline for the Canary Litecoin ETF amid the government shutdown, delaying its approval and raising market concerns.

The U.S. government shutdown has led to a delay in the approval of the Canary Litecoin ETF. The SEC was expected to decide on the ETF by October 2. However, due to the shutdown, this final decision has been postponed. This delay has sparked concerns about the future of other pending crypto ETFs.

SEC Misses Deadline for Canary Litecoin ETF Decision

The SEC had a deadline to approve or deny the Canary Litecoin ETF by October 2. With the shutdown in place, the commission missed this deadline. As a result, the decision on the ETF will now be delayed until government operations resume. This move marks a setback for the crypto community, which had high hopes for the ETF’s approval.

NEW: 🇺🇸 $LTC | The SEC missed Thursday's deadline for Canary Capital's spot Litecoin ETF decision amid government shutdown.

Bloomberg analysts note old 19b-4 deadlines may be irrelevant as SEC transitions to new generic listing standards. pic.twitter.com/s5z3ndX2f0

— crypto.news (@cryptodotnews) October 3, 2025

The ETF was expected to be the first to be approved for altcoins under the Securities Exchange Act of 1933. With the missed deadline, there is uncertainty about the approval timeline. Some market participants are now questioning how this delay may affect other altcoin ETFs, like those for XRP, Solana, and Dogecoin.

Bloomberg Analyst Comments on SEC’s ETF Process

James Seyffart, a Bloomberg ETF analyst, offered insight into the situation. He explained that the missed deadline might not significantly affect the approval process in the long run. “The deadline date might not matter at all,” Seyffart said, suggesting that the SEC could approve the ETF once government operations resume.

Lot of questions from clients and people on here because the @CanaryFunds Litecoin filing was technically due today under 19b-4. But as multiple people have reported (including @EleanorTerrett) it looks like SEC wants everyone to file under the new Generic listing standards for… https://t.co/HdmW7IfQjg

— James Seyffart (@JSeyff) October 2, 2025

Despite this, he acknowledged the uncertainty surrounding the timing of other pending ETF approvals. Seyffart pointed out that the SEC’s decision-making process remains dependent on government activity. As government operations continue to be disrupted, many are left waiting for a clearer timeline.

Litecoin Price Responds to ETF Delay

Litecoin (LTC) saw a price increase of over 15% leading up to the expected approval of the Canary Litecoin ETF. However, the price has since stabilized as news of the delay spread through the market. Currently, LTC is trading at $117.92, showing some signs of recovery after the initial surge.

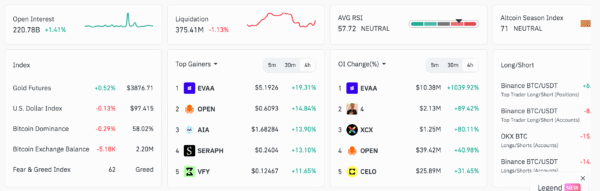

Despite the price leveling off, Litecoin’s futures market continues to show strong interest. According to CoinGlass data, the open interest in Litecoin futures rose by 4% to nearly $963 million in the past 24 hours. This rise in open interest reflects a continued interest in Litecoin, despite the uncertainty around the ETF.

Though the futures market shows mixed sentiment, overall trading volumes are lower. Some exchanges, like Binance, showed a decrease in open interest for short-term contracts, while platforms like OKX saw increases. This mixed sentiment indicates that traders remain cautious, even as Litecoin continues to draw attention.