A Cardano chain split, caused by a software flaw, disrupted users. ADA fell over 7% as network instability and slow block production occurred.

A recent “chain split” event occurred on the Cardano network. It was triggered by a malformed transaction. This took advantage of a flaw in the software. It caused a considerable user disruption. This contributed to a drop in the price of its native token, ADA. The incident resulted in network instability. It was also slowing down block production. ADA fell more than 7% as a result.

Software Flaw Causes Network Divergence

The disruption in the network took place on November 21, 2025. Specifically, a “malformed” delegation transaction was processed. This was a problematic transaction.

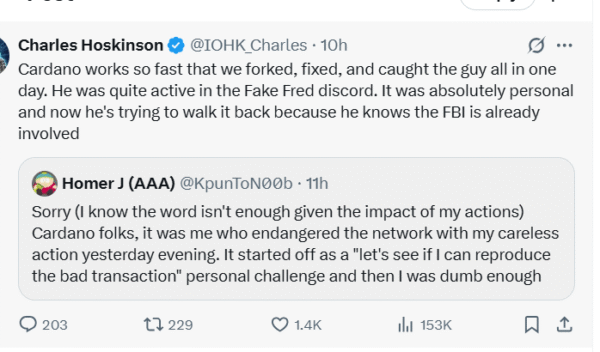

There was a premeditated attack from a disgruntled SPO who spent months in the Fake Fred discord actively looking at ways to harm the brand and reputation of IOG. He targeted my personal pool and it resulted in disruption of the entire cardano network.

Every single user was…

— Charles Hoskinson (@IOHK_Charles) November 21, 2025

This, therefore, led to the split. Nodes with newer versions of software accepted it. However, nodes on older versions rejected it. This caused a split into the blockchain.

Therefore, the blockchain effectively became divided. It formed two temporary, distinct chains. One chain had the “poisoned” transaction on it. The other, healthy chain, worked without it.

Related Reading: ETPs News: 21Shares Adds Cardano and Five New Crypto ETPs on Nasdaq Stockholm | Live Bitcoin News

Earlier that day, Cardano co-founder Charles Hoskinson posted on X. He called it a “premeditated attack.” He attributed it to an angry stake pool operator. This operator apparently tried to damage the brand and reputation of Cardon developer Input/Output Global.

According to Hoskinson, all the Cardano users were impacted. This highlights the massiveness of the disruption. The cause of the incident was found to be a software flaw. This bug was in an underlying software library. The validation code of the node did not trap it properly. As a result, this enabled the malformed transaction to continue. This led to the chain split.

The event affected all Cardon users. This led to slow block production. Network congestion was also an issue. Some large cryptocurrency exchanges responded. Upbit, for example, temporarily suspended deposits and withdrawals of ADA. This was a measure to take no chances.

Eventually, the Cardon ecosystem’s governance organization, Intersect, published an incident report. The problem touched on the critical importance of network resilience.

Market Reaction to Cardano’s “Perfect Storm”

Cardano co-founder Charles Hoskinson first posted the idea of “premeditated attack.” He blamed a disgruntled stake pool operator. Later reports, however, dwelt more on the technical flaw. A public apology by the user involved also followed.

The glitch tipped existing market pressures. This caused a severe drop in ADA’s price. The token was already in bearish sentiment.

The price fall was higher than the worldwide decline of the crypto market at the time. This raised concerns about the short-term resilience of ADA. Analysts called the situation a “perfect storm.” This greatly accelerated the sell-off.

Indeed, this incident shows the complexity of blockchain networks. It also emphasizes the importance of good software testing. Moving forward, network upgrades will probably be the top priority for the Cardano community. This is to try to prevent similar incidents. Such events often test investor confidence and network stability.