Cardano Price Prediction discussions have intensified as market participants reassess capital allocation during a period of reduced momentum across several large-cap digital assets. As liquidity rotates, attention is shifting toward projects demonstrating visible progress, clear utility, and defined rollout timelines.

One such project gaining early interest is Remittix, a PayFi-focused platform designed to connect crypto with real-world payments, currently priced at $0.123 per token. While ADA remains the focus of this article, broader capital movement provides important background for current market behavior.

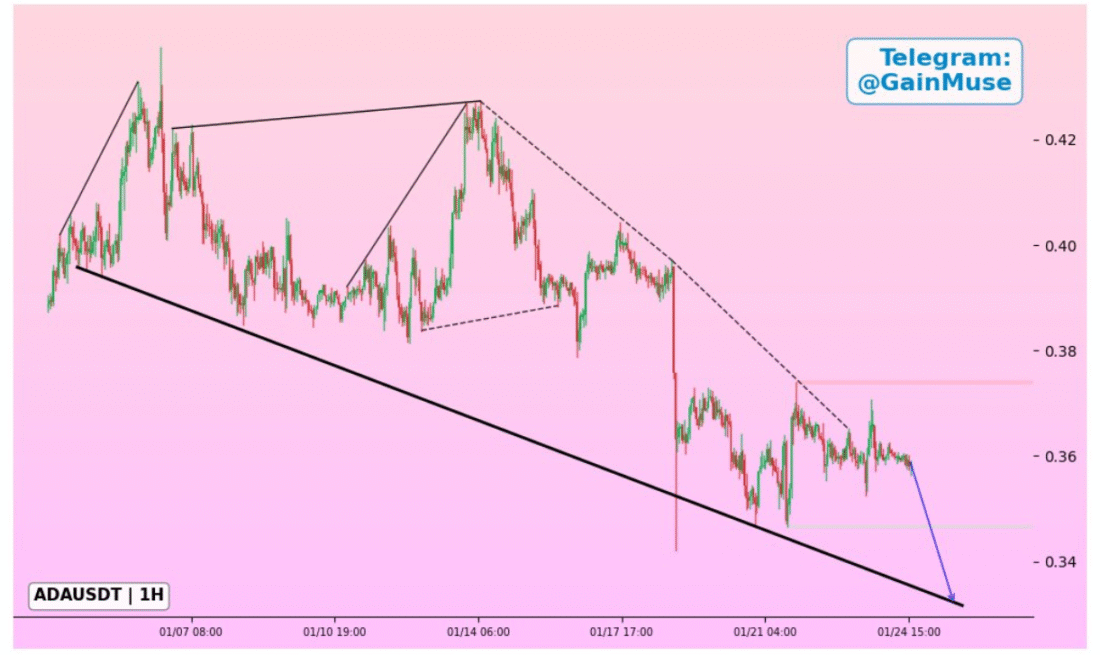

Cardano Price Prediction as ADA Breaks Key Technical Structure

The current Cardano Price Prediction outlook has weakened after ADA slipped below a tightly held consolidation range. The breakdown from compression has placed price action beneath a descending technical guide, reflecting limited buying response at current levels.

ADA is currently trading at $0.3588, down 0.68% over the last 24 hours. The market capitalization currently stands at 12.94 billion. The trading volume has decreased considerably to 208.51 million, down by more than 53% on a day-to-day basis. This speaks to a lack of speculation in the market.

Technical commentary shared by GainMuse highlights a bearish-leaning structure, with downside continuation possible unless price reclaims trend resistance. Support is currently monitored near $0.34, while overhead pressure remains close to $0.37.

A sustained move above the descending trendline would be required to alter this Cardano Price Prediction scenario. Market discussion around this setup is also visible in this CoinMarketCap community update.

Liquidity Rotation and the Shift Toward Utility-Driven Projects

As the Cardano Price Prediction weakens in the short term, on-chain behavior suggests larger holders are reallocating liquidity rather than exiting the market entirely. This pattern often appears during periods when major assets stall and capital looks for clearer growth narratives tied to real use cases.

This shift has brought renewed focus to early-stage infrastructure projects with defined delivery schedules. Remittix has appeared in these conversations because of the design of payments focus and obvious milestones of execution.

The project has managed to raise over $28.8 million in private funding; more than 701.6 million tokens have been sold, accounting for more than 93% of its total available supply. With availability narrowing, market urgency is building as remaining allocation becomes limited.

Remittix is structured around solving cross-border payment inefficiencies by enabling crypto-to-fiat transfers directly into bank accounts. Already live in the Apple App Store, the next confirmed release will be in Google Play. The full PayFi platform will go live on 9 February 2026, which will mark the first full deployment of its ecosystem.

Why Remittix Is Drawing Attention as ADA Momentum Slows

While Cardano Price Prediction analysis remains tied to technical recovery levels, Remittix is being evaluated on execution rather than chart structure. The platform is designed to support real payment flows rather than passive holding, a distinction increasingly valued during uncertain market phases.

Key factors currently supporting Remittix adoption include:

- Wallet live on the App Store with core transfer functionality

- Crypto-to-fiat payment integration scheduled with platform launch

- Raised over $28.8 million from private funding, showing institutional confidence

- CertiK team verification and ranking as the #1 pre-launch project on the platform

- Confirmed future centralized exchange listings, with BitMart and LBank revealed

This leaves the price of the Remittix token unchanged at $0.123, placing it among top crypto under $1 discussions anchored around use-case orientated adoption and not speculation-driven narratives. As liquidity rotates away from stalled majors, projects offering crypto with real utility are increasingly prioritized by market participants tracking the next major infrastructure rollout.

From Price Charts to Payment Rails

The broader Cardano Price Prediction story reflects a market waiting for renewed conviction. Until ADA reclaims higher technical levels, capital movement is likely to remain selective.

Remittix represents one of the clearer examples of where that liquidity may continue flowing, supported by a live wallet, a scheduled PayFi launch, and a defined roadmap toward real-world payment usage.

With more than 93% of tokens already allocated and platform access approaching, timing has become a central theme in current market positioning. As investors monitor ADA’s next move, attention remains fixed on projects that are converting development into deployable systems rather than relying on price action alone.

Discover the future of PayFi with Remittix by checking out their project here:

Website: remittix.io

Socials: https://linktr.ee/remittix

FAQs

What is the current Cardano Price Prediction based on market structure?

The current Cardano price prediction is still a little apprehensive as the token trades below the specified resistance points. Further weakness may be observed unless the descending line near the $0.37 mark is cleared.

Why are whales moving liquidity away from ADA right now?

Lower trading volume and weak follow-through have encouraged large holders to rotate capital into crypto with real utility, particularly projects showing active development and near-term platform launches.

How does Remittix compare as an alternative investment narrative?

Remittix is positioned as a PayFi-focused DeFi project with a live wallet, a confirmed platform launch on 9 February 2026, CertiK verification, and over $28.8M raised from private funding, with the token priced at $0.123.

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release