Large investors in Cardano are increasing their holdings, and this is raising interest across the market. Recent accumulation by whale wallets is being closely watched, as analysts connect the moves with potential price shifts. The activity has stirred discussions about Cardano’s support levels, technical upgrades, and possible long-term targets.

Whales Increase ADA Holdings Rapidly

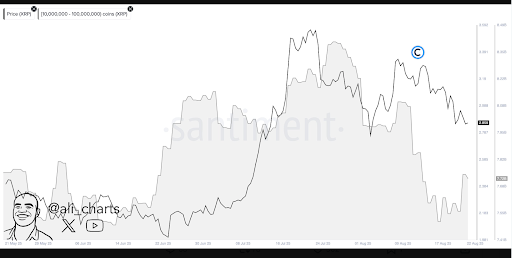

Crypto analyst Ali Charts reported that whale wallets holding between 10 million and 100 million ADA purchased around 180 million tokens within 48 hours. This scale of accumulation is unusual in short periods and points to active buying pressure at current levels. These wallets are typically considered long-term holders rather than short-term traders.

The current buying trend is different from retail activity because of the size and pace of accumulation. Data suggests that whales may see Cardano’s present price range as attractive for positioning. Past whale movements have often been followed by noticeable shifts in market direction.

At the same time, Cardano’s trading price has stayed steady above the $0.85–$0.90 zone, which analysts describe as an accumulation range. Altcoinpedia noted that traders are treating this area as a base for possible upward moves. If momentum strengthens, attention could shift toward resistance between $1.10 and $1.20.

Market Levels and Technical Factors

Cardano has maintained support in recent trading sessions, with price stability linked to consistent whale accumulation. Traders have been watching the $0.70 level as an important threshold because it has formed a base for past rallies. Analyst Javon Marks suggested that if this level flips into support, ADA could confirm a breakout pattern.

Marks pointed out that the chart structure is similar to the pattern formed during the 2020 rally. According to his analysis, the formation of higher lows reflects strength building over time. He mapped a possible long-term price projection of $8 if the breakout gains traction.

Meanwhile, TapTools reported that Cardano’s total value locked has crossed $400 million, which reflects growing activity in decentralized applications. This level of locked value is viewed as support for the broader network because it shows rising use cases. The combination of network expansion and steady accumulation strengthens the current focus on Cardano’s position.

JUST IN: Cardano $ADA has surpassed $400 million in total value locked (TVL). pic.twitter.com/SHjUHJLPSP

— TapTools (@TapTools) August 22, 2025

Scalability Developments and Whale Confidence

Recent improvements in the Hydra upgrade have supported Cardano’s capacity to handle faster and cheaper off-chain transactions. The upgrade is designed to scale the network and make it more efficient for decentralized finance and smart contract development. These upgrades may increase interest among developers and investors seeking reliable infrastructure.

Large holders continue to buy during this period of technical progress, which suggests that they are aligning with the long-term setup. This accumulation is seen as a signal that strong buyers are positioning before further price changes.

The combination of whale accumulation and Hydra’s growth is drawing attention from the wider market. While prices remain in a consolidation zone, the activity of large holders has become a key focus. Analysts are now watching whether Cardano can move toward its next resistance and sustain momentum from accumulation.