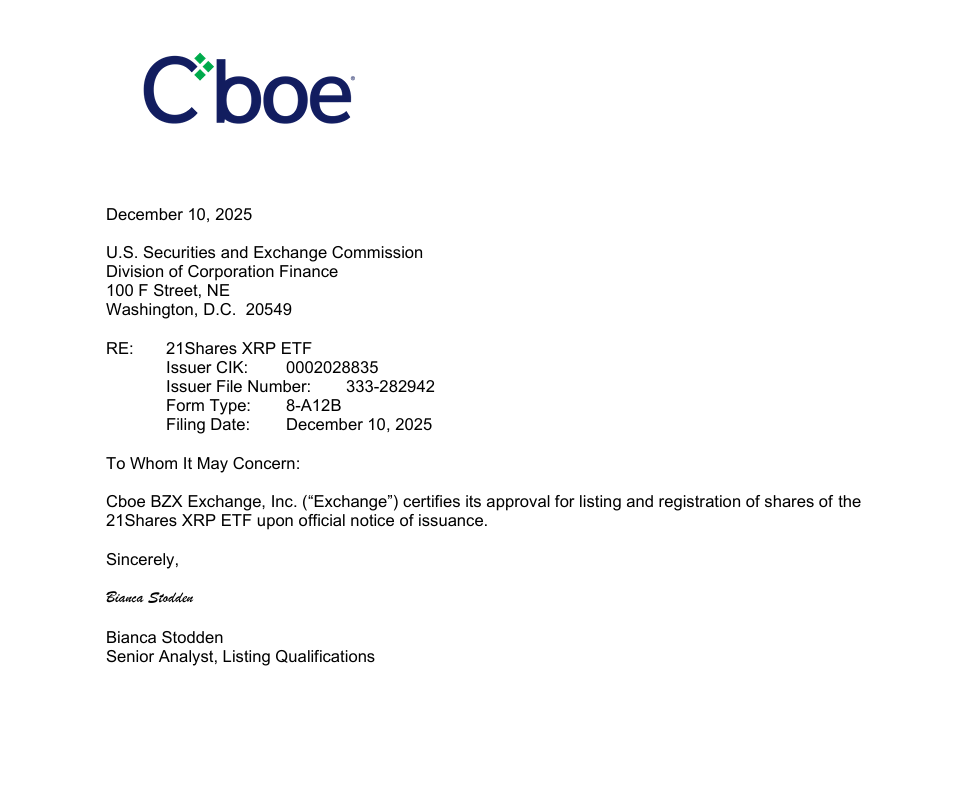

Cboe BZX Exchange approved the 21Shares XRP ETF for listing. This decision was revealed in a new SEC filing. The product is now ready for immediate launch.

Cboe BZX Exchange confirmed it has officially approved the listing. This approval also covers the registration of the 21Shares XRP ETF. This information was received through a Wednesday filing with the SEC. Consequently, this key approval is a go-live for the product. This is awaiting only the final official notice of issue.

New ETF Tracks CME CF XRP-Dollar benchmark

The 21Shares XRP ETF seeks to track a certain performance benchmark. This is the CME CF XRP-Dollar Reference Rate-New York Variant. The goal of the fund is to provide direct exposure to the XRP. XRP is currently the fourth-largest crypto asset in terms of market capitalization. This positioning was confirmed by its new prospectus.

Related Reading: Crypto News: NYSE Approves Grayscale DOGE and XRP ETFs for Monday Trading | Live Bitcoin News

Shares of the fund are now planning to trade on Cboe BZX Exchange. The listing for the product will be under the ticker symbol TOXR. The fund will impose an annual sponsor fee of 0.3% on the investors. This fee is computed daily and paid in a weekly basis in XRP.

The fundamental purpose of the fund is to give this exposure to investors concerning “the price of XRP”. This is managed by the tracking of the CME CF XRP-Dollar Reference Rate Rate of Pricing benchmark. This enables transparency and accuracy in valuation.

Several trusted entities would serve as custodians to the XRP contained in the fund. These include Coinbase Custody Trust Company, Anchorage Digital bank and BitGo Trust. This gives institutional-grade security. The management fee for the fund undermines to be within the range of 0.25% to 0.40%.

Institutional Flows Drive Growth of XRP Market

The 21Shares XRP ETF is among many spot XRP ETFs to launch in the U.S. It is pooling products from other major issuers. These include companies such as Canary Capital, Bitwise, Franklin Templeton and Grayscale. The appearance of these products represents a drastic change in the market.

Collectively, these U.S. XRP ETFs have already seen unbelievably high institutional investment. Net inflows were more than $666 million a short time after their initial launch. Furthermore, total assets under management also have grown rapidly. In the meantime, these assets would now exceed $1.2 billion by early December 2025.

This enormous flow of institutional capital has played a major role. It has retained an active support to the recent price movements of XRP. The approval of the 21Shares product is expected to continue this momentum even more.

The introduction of several successful XRP ETFs speaks volumes to the institutional appetite for the asset. This comes and follows positive regulatory clarity in the U.S. recently. The structured ETF format brings a construct of clear and regulated exposure gain.

Ultimately, this final stamp of approval by Cboe opens the door to expansion in the market. It creates another transparent medium for capital inflow. This significantly gives credit to where XRP ranks within the regulated investment space.