Chainlink nears a 2021 peak as whale buying, smart money flows, and institutional adoption fuel a bullish cycle.

Chainlink’s price has surged to its highest level in over two years, with investors discussing a possible new institutional-driven cycle. Chainlink, which climbed above $26.70 this week, is on track for one of its strongest monthly closes since 2021, supported by growing whale activity, smart money accumulation, and expanding institutional use cases.

Whale Accumulation and Smart Money Buying

Chainlink has seen a rise in large investor activity in August. Data from Nansen shows whale holdings have increased by 27% over the last 30 days, climbing to 5.47 million LINK tokens. This continues a trend from last year when holdings stood at less than 3 million.

At the same time, addresses linked to experienced traders have also been adding LINK. According to the latest figures, smart money wallets purchased more LINK than any other token in the past week. This suggests that seasoned investors see more room for growth, with many moving coins off exchanges. The number of LINK tokens held on exchanges has dropped from 280 million to 270 million this month, which may reduce immediate selling pressure.

Crypto analyst Crypto Bullet described the weekly chart as “very strong” and suggested that the token could move toward $100 by year-end. While ambitious, such commentary reflects the optimism now visible across social media and trading communities.

Technical Momentum Nears Key Levels

Chainlink’s daily chart is forming a classic cup-and-handle pattern, often viewed as a bullish structure. The current range has a lower base near $10 and resistance around $30. If the formation completes, the breakout projection could place LINK close to its all-time high of $51.

Funding rate data from CoinGlass also points to ongoing bullish sentiment. Rates have remained positive since June, which means long positions are paying short positions, often signaling confidence in price continuation. Open interest has reached a record $1.58 billion, showing increased liquidity and demand for perpetual futures.

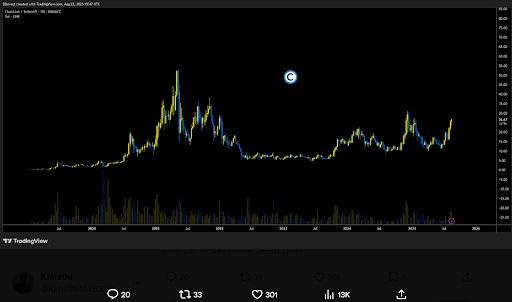

Another analyst, Aylo noted that Chainlink’s monthly candle is now approaching its highest close since 2021. He said that if the level holds, it could mark the beginning of what many describe as an “institutional cycle.” This narrative has been fueled by the network’s partnerships with major firms, including JPMorgan, SWIFT, UBS, and Coinbase.

Still a bit of time till the end of the month, but right now the $LINK monthly is looking very good.

If we close anywhere near here then it would be the highest monthly close since 2021.

New era.

Institutional cycle.

Send it much higher. pic.twitter.com/KpCyi6j7aG

— Aylo (@alpha_pls) August 22, 2025

Institutional Adoption and Reserve Growth

Beyond trading activity, Chainlink is advancing through new institutional initiatives. The network recently launched the Strategic LINK Reserve, which accumulates tokens from real revenue generated by services and fees. The reserve now holds over 150,000 LINK, worth about $3.8 million, after a $1 million addition earlier this week.

Chainlink has also secured compliance certifications, including ISO 27001 and SOC 2. These standards are widely adopted in the banking sector, which strengthens its ability to integrate with financial institutions. By aligning with regulatory expectations, Chainlink is positioning itself as a trusted oracle provider for tokenized assets and cross-bank settlements.

Although LINK faced resistance near $27 and fell by 5% after profit-taking, analysts suggest the reserve’s continued expansion could support long-term demand. The project’s growing institutional connections and its ability to convert revenue into on-chain token reserves may further reinforce investor confidence.